The Venezuelan businessman quietly established a complex corporate structure until last February the US Treasury Department accused him of being the "front man" of the Vice President of the Republic, Tareck El Aissami. The Paradise Papers leak now reveals that his business assets are broader than those initially blocked by the US authorities and that the island of Barbados was chosen to create a sort of holding that groups the companies with which he participated in the oil and food business, among others, and whereby he was awarded millionaire contracts with the Venezuelan government.

|

Getting your Trinity Audio player ready...

|

A check for 8 million 500 thousand bolivars, dated September 2010, is a milestone in the business career of Samark José López Bello. The payment —equal to 1.9 or 3.2 million dollars, based on the two official exchange rates existing at that time in Venezuela— allowed López Bello, with only 36 years of age, to assume the majority shareholding of Profit Corporation C.A., an engineering company founded in the 90s. A month earlier, Armando José Salazar Gibory and Marcos Rafael Cabello Bello had acquired it, two names that will accompany Samark López in several of the companies that he surreptitiously accumulated until the US Treasury Department proclaimed him the "front man" of Tareck El Aissami, vice president of the Republic.

It was in February when the Office of Foreign Assets Control (OFAC) accused him of "providing material assistance" and "financial support" to El Aissami, whom the administration of Donald Trump links to drug trafficking. US authorities sanctioned 13 assets in up to five jurisdictions: Venezuela, Panama, the British Virgin Islands, the United Kingdom and the United States of America. "We have frozen assets, tens of millions of dollars in assets that will have a very big impact for El Aissami and his environment," summarized Secretary of the Treasury Steve Mnuchin.

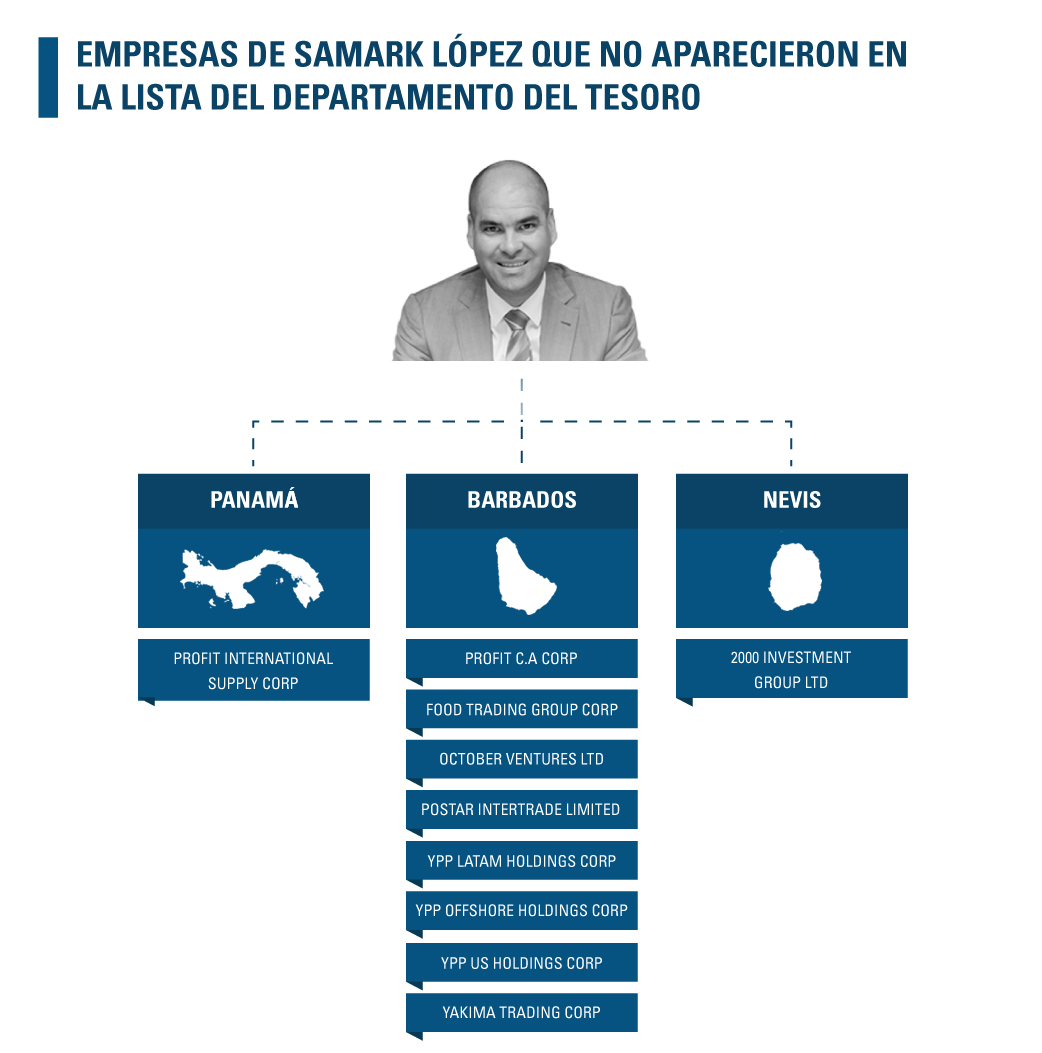

The leak of the so-called Paradise Papers containing millions of documents from the Appleby law firm in Bermuda and commercial records of several tax havens, obtained by the German newspaper Süddeutsche Zeitung and shared by the International Consortium of Investigative Journalists (ICIJ), shows that the corporate structure established by Samark López is broader than that portrayed by the Treasury Department. Thus, while Venezuela began its "great depression", the entrepreneur did not stop expanding, while protecting his private treasure on the island of Barbados. "He has many other companies that did not appear in the designating," acknowledges his legal team that agreed to answer the questions for this report anonymously. "Maybe they had not detected them in the research they were doing, so they were not listed in the initial publication they made," he adds.

From the moment the news circulated, there was a sense that Samark López's assets listed by OFAC were incomplete. Almost simultaneously with the publication of the sanctions, a ship with thousands of boxes of food for the Local Supply and Production Committee (CLAP) —the plan devised by Nicolás Maduro to face the general shortage that has punished the population for three years— left from the port of Veracruz, Mexico, to the port of Puerto Cabello, two hours from Caracas. The goods were shipped by Postar Intertrade Limited, an unknown company that did not appear in the organization chart of OFAC, but which Samark López presumed of on his website and whereby he sealed at the end of 2016 a contract for 120 million dollars with Corporación Venezolana de Comercio Exterior (Foreign Trade Venezuelan Corporation) (Corpovex), the state holding that centralizes imports.

For the Venezuelan authorities Postar Intertrade Limited was familiar. Before that business, Samark Lopez used it to dispatch construction materials and even Christmas trees, as well as almost 455 thousand tons of bulk food (yellow corn, white corn and wheat) to the Venezuelan government from last year’s June to December.

Initially registered in the British Virgin Islands in 2013, Postar Intertrade Limited is a company domiciled since 2016 in that peaceful corner of the Caribbean called Barbados. The leaked papers also show that the owner of the 50 thousand shares (1 dollar each) is another company called 1000 Investments Group Limited in the jurisdiction of the British Virgin Islands and also related to Yakima Oil Trading LLP, another property of the Venezuelan entrepreneur, registered in the United Kingdom.

"What I can tell you is that this is his holding and of his family"

Although Yakima Oil Trading LLP appeared in the business chart blocked by the United States of America to Samark Lopez, neither Postar Intertrade Limited nor 1000 Investment Group Limited are in that list of assets of the Venezuelan entrepreneur. "Postar was redomiciled to Barbados in search of a better tax treatment, because Barbados is not on the black list (of the Seniat, tax office in Venezuela), where he is a tax resident, and in that way, he is in compliance with all his tax obligations," his legal team explains. They refer to the fact that the island is not considered a tax haven in the eyes of the Venezuelan authorities, an advantage highlighted by Trident Trust, the registrar of Samark López’s companies, on its website to attract Venezuelan customers. "Today, Barbados offers an attractive option in international structuring for Venezuelans, since Barbados is not listed and has a tax treaty with Venezuela."

The lawyers say that 1000 Investment Group Limited "was ordered to be liquidated", but the new holding company of the shares of Postar Intertrade Limited still belongs to Samark López, although they did not disclose the name. "What I can tell you is that this is his holding and of his family," they say.

The documentation shows that the director of Postar Intertrade Limited is Amaury José Salazar Gibory, brother of Armando José Salazar Gibory, one of the two partners with whom Samark López assumed control of Profit Corporation in Venezuela. This company appears on the list of assets blocked by OFAC, but not the company under the name of Profit C.A. Corp, also registered in Barbados. According to the lawyers, the company was created for "projects on an international level with the name of Profit, but the company never had any activity, neither a bank account."

When Profit C.A. Corp was registered in September 2015, Samark López had already acquired all of Profit Corporation's shares in Caracas. The names that appear in the registry of the Caribbean island were the same as in Venezuela, i.e. Samark López with Armando José Salazar Gibory and Marcos Rafael Cabello Bello, the two Venezuelans who allowed him to take control of the company in Venezuela since 2010. "Later in August 2010, the company was transferred to new hands, full of skills and dynamism, with experience in the national and international market, who acquired the entire company," summarizes the electronic portal of Profit Corporation.

The site also states that as soon as the company changed hands, the contracts with the big Venezuelan state companies arrived. "Our main customers are Petróleos de Venezuela (Pdvsa) and its subsidiaries Pdvsa Gas and Pdvsa Petróleo," says the website. The installation of a turbogenerator in San Joaquín Plant and the works for Soto deep extraction plant, both in the state of Anzoátegui and contracted by Pdvsa Gas, are two of the eight projects that Profit Corporation achieved after the company was transferred to the hands of Samark López.

Another key step for these businesses was that in 2010, the company was enrolled in the program of Social Production Companies (EPS) of Pdvsa and its subsidiaries —an idea of ??the then president Hugo Chávez for the development of the oil industry—, as evidenced in the mercantile file of Profit Corporation.

Neither the company nor Samark López have revealed the value of the contracts signed by Profit Corporation with the Venezuelan state-owned companies, but through ImportGenius, an international trade database, it is possible to at least verify that from June 2012 to November 2017, the CIF value (includes insurance and freight) of the imports made by the company was almost 18 million dollars in industrial items like machinery and pipes, but also in toys, tableware, doors and their frames, among other goods.

If Venezuela has experienced an extended economic contraction since 2013, for Samark López the last years were of amplification, judging from the leaked documents of the Barbados trade registry. The papers show that in the last four years, the Venezuelan entrepreneur was creating his own holding on the island, business architecture like those established by big transnational corporations like Nike and Apple in tax havens, which have been uncovered with the global Paradise Papers investigation.

"It is exclusively related to tax matters, but if it were the opacity issue only, no one can really know who the shareholders of a company in Barbados are, except the people who organized it. The aim is to have a holding company like big companies in the world do, like Apple does," argue Samark López’s advisors.

However, the US authorities consider the scheme devised by the entrepreneur as distrustful. In August, the Financial Crimes Enforcement Network (Fincen), also attached to the Treasury Department, mentioned Samark López as a potential case in which drug trafficking, luxury real estate and cash shell companies are intermingled.

The corporate structure established by the Venezuelan entrepreneur, Yakima Trading Corp was "re-domiciled" in Barbados in 2016, like Postar Intertrade Limited. The company was born in 2002 in Panama, but it is in the hands of Samark López and his partners (José Esteban Chacín Bello and Enrique Alberto Chacín Bello) since 2012, at which time its capital went from 10 thousand dollars to 10 million dollars. Both Yakima Trading Corp and Yakima Oil Trading LLP, registered in the United Kingdom, were mentioned by OFAC last February.

Like Profit Corporation, with Yakima Trading Corp Samark López achieved business with the Venezuelan oil company. Between 2015 and 2016, that company supplied Pdvsa Industrial materials like steel coils, steel shot, welding wire and other steel materials in at least five shipments that arrived at the port of Puerto Cabello, in the state of Carabobo, center of the country. "We are a corporation with a diversity of products and brands that offers solutions to major companies in the oil, petrochemical, industrial and construction sectors, particularly in Venezuela and the region," says the company's website.

Yakima Oil Trading LLP is controlled, in turn, by two other companies, the final beneficiary of which is Samark López, 2000 Investment Group Ltd, registered in Nevis, and YPP Offshore Holdings Corp, registered in Barbados. The company was registered on the island on November 19, 2015, and the names of Armando José Salazar Gibory and Marcos Rafael Cabello Bello, the two who have accompanied Samark López since 2010 in Profit Corporation, appeared again in the board. "No share in the capital of the company will be transferred without the approval of the directors of the company or a committee of said directors, evidenced by resolution," says one of the documents.

Also in November 19, 2015, Samark López and the two partners created companies with similar names in Barbados, namely, YPP Latam Holdings Corp and YPP Us Holdings Corp, both aimed at "holding shares of a Venezuelan company." The legal team ensures that the objective of the companies under the name of YPP was to act as "holdings to hold the shares of operating companies".

In addition to this network, there are at least two other companies, October Ventures Ltd, registered on October 17, 2014, and Food Trading Group Corp, registered on March 13, 2015. In the first, Armando José Salazar Gibory and Marcos Rafael Cabello Bello reappear as directors, while in the second, these positions are held by José Esteban Chacín Bello and Enrique Alberto Chacín Bello. According to the attorneys of Samark López, neither of these companies specified the businesses for which they were created. It is also not clear if at any time these two and the rest of the companies in Barbados will be able to carry out any activity. By not being listed by OFAC they can work, as long as they do not make transactions in dollars or use the US financial system. However, the brisk expansion of Samark López seems to have slowed down.

The accusation of the Treasury Department has knocked down or, at least, paralyzed the plans of the entrepreneur. He has personally acknowledged that after the accusation of the US authorities, the business of Postar Intertrade Limited with Corpovex for the supply of food for the Local Supply and Production Committee (CLAP) was suspended and that he has put all his businesses on "stand by", something that his lawyers repeat. "Right now, none of the companies are formally active, none are operating. They are on standby until the issue of the sanctions is resolved." The administration of Donald Trump has the last word.

Adrián Perdomo Mata has just entered the list of sanctioned entities of the US Department of the Treasury, as president of Minerven, the state company in charge of exploring, exporting and processing precious metals, particularly gold from the Guayana mines. His arrival in office coincided with the boom in exports of Venezuelan gold to new destinations, like Turkey, to finance food imports. Behind these secretive operations is the shadow of Alex Saab and Álvaro Pulido, the main beneficiaries of the sales of food for the Local Supply and Production Committee (Clap). Perdomo worked with them before Nicolás Maduro placed him in charge of the Venezuelan gold.

Gassan Salama, a Palestinian-cause activist, born in Colombia and naturalized Panamanian, frequently posts messages supporting the Cuban and Bolivarian revolutions on his social media accounts. But that leaning is not the main sign to doubt his impartiality as an observer of the elections in Venezuela, a role he played in the contested elections whereby Nicolás Maduro ratified himself as president. In fact, Salama, an entrepreneur and politician who has carried out controversial searches for submarine wrecks in Caribbean waters, found his true treasure in the main social aid and control program of Chavismo, the Clap, for which he receives millions of euros.

While the key role of Colombian entrepreneurs Alex Saab Morán and Álvaro Pulido Vargas in the import scheme of Nicolás Maduro’s Government program has come to light, almost nothing has been said about the participation of the traders who act as suppliers from Mexico. These are economic groups that, even before doing business with Venezuela, were not alien to public controversy.

Even though there are new brands, a new physical-chemical analysis requested by Armando.Info to UCV researchers shows that the milk powder currently distributed through the Venezuelan Government's food aid program, still has poor nutritional performance that jeopardizes the health of those who consume it. In the meantime, a mysterious supplier manages to monopolize the increasing imports and sales from Mexico to Venezuela.

Turkey and the coastal emirates of the Arabian Peninsula are now the homes of companies that supply the main social -and clientelist- program of the Government of Venezuela. Although the move from Mexico and Hong Kong, seems geographically epic, the companies has not changed hands. They are still owned by Colombian entrepreneurs Alex Nain Saab Morán and Álvaro Pulido Vargas, who control since 2016 a good part of the Import of food financed with public funds. Around the world for a business.

Since the borders to Colombia and Brazil are packed and there is minimal access to foreign currency to reach other desirable destinations, crossing to Trinidad and Tobago is one of the most accessible routes for those in distress seeking to flee Venezuela. Relocating them is the business of the 'coyotes' who are based in the states of Sucre or Delta Amacuro, while cheating them is that of the boatmen, fishermen, smugglers and security forces that haunt them.

When Vice President Delcy Rodríguez turned to a group of Mexican friends and partners to lessen the new electricity emergency in Venezuela, she laid the foundation stone of a shortcut through which Chavismo and its commercial allies have dodged the sanctions imposed by Washington on PDVSA’s exports of crude oil. Since then, with Alex Saab, Joaquín Leal and Alessandro Bazzoni as key figures, the circuit has spread to some thirty countries to trade other Venezuelan commodities. This is part of the revelations of this joint investigative series between the newspaper El País and Armando.info, developed from a leak of thousands of documents.

Leaked documents on Libre Abordo and the rest of the shady network that Joaquín Leal managed from Mexico, with tentacles reaching 30 countries, ―aimed to trade PDVSA crude oil and other raw materials that the Caracas regime needed to place in international markets in spite of the sanctions― show that the businessman claimed to have the approval of the Mexican government and supplies from Segalmex, an official entity. Beyond this smoking gun, there is evidence that Leal had privileged access to the vice foreign minister for Latin America and the Caribbean, Maximiliano Reyes.

The business structure that Alex Saab had registered in Turkey—revealed in 2018 in an article by Armando.info—was merely a false start for his plans to export Venezuelan coal. Almost simultaneously, the Colombian merchant made contact with his Mexican counterpart, Joaquín Leal, to plot a network that would not only market crude oil from Venezuelan state oil company PDVSA, as part of a maneuver to bypass the sanctions imposed by Washington, but would also take charge of a scheme to export coal from the mines of Zulia, in western Venezuela. The dirty play allowed that thousands of tons, valued in millions of dollars, ended up in ports in Mexico and Central America.

As part of their business network based in Mexico, with one foot in Dubai, the two traders devised a way to replace the operation of the large international credit card franchises if they were to abandon the Venezuelan market because of Washington’s sanctions. The developed electronic payment system, “Paquete Alcance,” aimed to get hundreds of millions of dollars in remittances sent by expatriates and use them to finance purchases at CLAP stores.

Scions of different lineages of tycoons in Venezuela, Francisco D’Agostino and Eduardo Cisneros are non-blood relatives. They were also partners for a short time in Elemento Oil & Gas Ltd, a Malta-based company, over which the young Cisneros eventually took full ownership. Elemento was a protagonist in the secret network of Venezuelan crude oil marketing that Joaquín Leal activated from Mexico. However, when it came to imposing sanctions, Washington penalized D’Agostino only… Why?

Through a company registered in Mexico – Consorcio Panamericano de Exportación – with no known trajectory or experience, Joaquín Leal made a daring proposal to the Venezuelan Guyana Corporation to “reactivate” the aluminum industry, paralyzed after March 2019 blackout. The business proposed to pay the power supply of state-owned companies in exchange for payment-in-kind with the metal.