Leonardo González Dellán headed Banco Industrial de Venezuela (BIV) from 2002 to 2004. The papers of Mossack Fonseca reveal that, in this period, which also coincided with the establishment of the exchange control and the birth of the extinct Cadivi, he was related to overseas companies.

|

Getting your Trinity Audio player ready...

|

On February 11, 2016, the history of Banco Industrial de Venezuela (BIV) ended. A resolution of the Superintendency of Banking Institutions (Sudeban) was the death certificate for a financial institution that was born in 1937.

"Agreeing the early dissolution of Banco Industrial de Venezuela, C.A. and the cessation of operations and financial intermediation activities and, thus, beginning the administrative liquidation process," provides Article 1 of the measure contained in Official Gazette 40.846.

But the end of BIV was written long ago. In 2011, the Office of the Comptroller General of the Republic (CGR) recommended ending the "intervention process," which the bank was subject to since 2009. It advised its "liquidation" in “order to preserve the interests of the Republic, the stability of the national financial system, and the rights of savers, depositors, customers and creditors, given that the bank had serious economic, financial and budget planning problems in 2007 and 2008."

Major losses, interventions and bailouts from the Government every so often were constant in the bank. The red figures were also part of the bad management and the permanent turnover of BIV’s board. In the first eight years of Hugo Chávez government, the bank had up to eight presidents.

One of them was Leonardo González Dellán, who, based on the papers of the Panamanian law firm Mossack Fonseca, is the beneficiary of several companies in tax havens. González Dellán was appointed by Chávez to head BIV in 2002 and held office until 2004, when he was replaced by Arné Chacón, the brother of former minister Jesse Chacón, who was arrested in 2009 in connection with the financial crisis that year.

The documents of Mossack Fonseca law firm, which Süddeutsche Zeitung of Munich received from an anonymous source and were reviewed by a team of over 370 journalists around the world under the coordination of the International Consortium of Investigative Journalists (ICIJ), prove that González Dellán was linked to offshore companies since he was at the head of BIV.

An email between executives of the Panamanian law firm dated April 4, 2013, leaves no doubt about the client. "In the Supreme Court of Justice of Venezuela there is a document in which Leonardo González Dellán acts as representative of Banco Industrial de Venezuela (BIV). This document indicates the full name and personal identification number that exactly matches the document of our director," the communication reads. It even details that "the contact of Leonardo González Dellán with Hugo Chávez was also found."

The first emails related to González Dellán go back to 2010, but the papers of the companies reveal that he was related to a company, whose settlement agent was Mossack Fonseca, since 2003.

The company is Blue Crest Holdings S.A., a company registered in Panama on August 20, 2003. "The authorized capital of the company is US $ 10,000, legal tender of the United States of America, divided into 100 shares that may be registered or bearer, at a par value of US $ 100 each. The board of directors may allow bearer certificates to be exchanged for certificates in the name of the owner and vice versa," reads the company's social agreement, a kind of articles of incorporation.

On August 21, 2003, four bearer certificates were issued, equal to one share each. On July 23, 2014, a fifth certificate for 100 shares was issued in favor of Leonardo González Dellán. But the relationship of the former president of BIV with company Blue Crest Holdings S.A. did not end there.

On October 20, 2003, the directors of Blue Crest Holdings S.A., appointed by Mossack Fonseca for that purpose, conferred José Ángel González Dellán a Power of Attorney to "manage the company without any limitation." He is the brother of the former president of BIV, who, based on the National Registry of Contractors (RNC), is the president of the Asociación Cooperativa Colosal XX, R.L., a company that has provided services to Petróleos de Venezuela (Pdvsa), as varied as the "supply of meals", "office construction and remodeling," and "road construction and signaling," among others.

Also on October 20, 2003, a Power of Attorney was issued in favor of Luis Alberto Benshimol, an investment advisor who was linked to several securities firms such as Lemon Casa de Bolsa in 2003 and later to Bencorp Casa de Bolsa C.A., one of the many intervened by the National Securities Commission in 2010, after the then Minister Jorge Giordani decided to finish with the sector.

As of July 21, 2005, Leonardo González Dellán had a Power of Attorney without limitations to manage Blue Crest Holdings S.A.

The period of González Dellán at the head of BIV coincides with the beginning of foreign exchange control decreed by Chávez in February 2003 and still in force, as well as with the origin of the extinct Currency Administration Commission (Cadivi). Several press releases from El Universal, published between 2003 and 2004 reveal BIV’s participation at that time.

On December 31, 2002, in the midst of the so-called "oil strike", Jesús Rodolfo Bermúdez, who was then Vice Minister of Finance, opened trusts in BIV to in the name of the Republic: one for 1,500 million dollars, through a promissory note at 18 months and a 14.5% rate, another for 700 million bolivars, and a third one for 1.413 million dollars.

According to the information at the time, the Ministry of Finance used that scheme to honor payment commitments to public entities and private companies, but "the promissory notes ended up injecting gas into the parallel currency market," El Universal reported on July 18, 2004. "In other cases, the companies demanded buyers, mainly banks and brokerage firms, to pay the promissory note at 100% of their face value, whereby financial institutions acquired US dollars at Bs. 1,600, exactly the price at which the Government gave foreign currency to the priority sectors of the economy in 2003," adds the release.

El Nacional newspaper published in 2007 information about the management of BIV during the Chávez government, summarizing González Dellán's step through the institution as follows: "Leonardo González Dellán, close to Copei (political party), was appointed president of BIV in November of 2002, but he left in July of 2004. By then, the delinquency reached 49%."

In the book El gran saqueo (The great sacking) by Carlos Tablante and Marcos Tarre, Leonardo González Dellán is identified as one of the financial "operators" who benefited during the Chávez administration through securities negotiations and transactions that allowed them to take advantage of the "exchange differential".

Son of the former Copei-member senator, Eudoro González, and brother of the current deputy of Primero Justicia (political party), Eudoro González, Leonardo González Dellán met Chávez at the beginning of his government and ended up forming part of his government. The papers of Mossack Fonseca confirm that González Dellán's relationship with the law firm and the companies in tax havens did not end with Blue Crest Holdings S.A. In December 2010, representatives of J. A. Fernández y Asociados, another Panamanian law firm, representing the former president of BIV, contacted Mossack Fonseca to request information on the availability to "reserve" some companies.

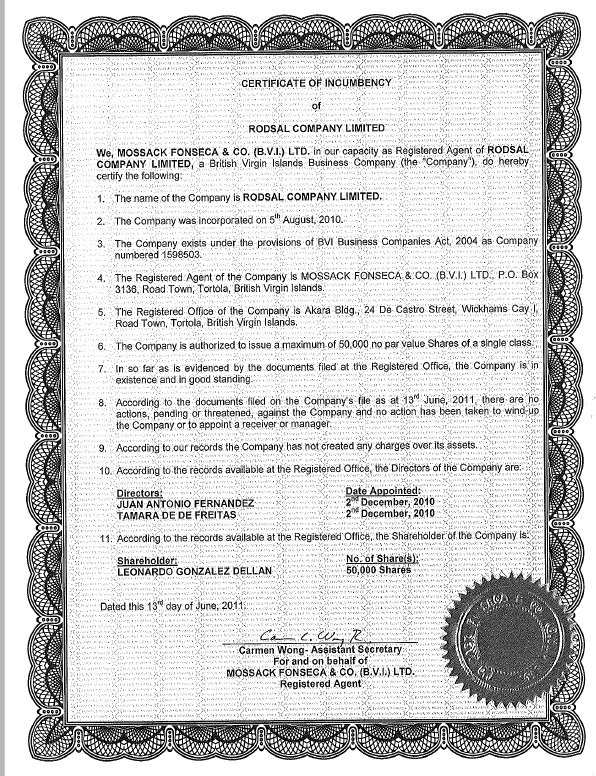

"Regarding the company concerned, we confirm that the sole shareholder is Leonardo González Dellán. Therefore, we request you to prepare a share certificate for the entire share capital in favor of González Dellán," reads an email dated December 7, 2010, sent from J. A. Fernández y Asociados to executives of Mossack Fonseca. The company was Rodsal Company Limited, registered by Mossack Fonseca on August 5, 2010, in the British Virgin Islands. "The company is authorized to issue a maximum of 50,000 shares without par value of the same class of shares," established the register of the company, whose shareholder until July 2013 was Leonardo González Dellán. Previously, there was a change of directors and finally a certificate was issued with the 50 thousand shares in favor of Weltrust, a Swiss company, and the law firm Python & Peter became its settlement agent until the company was dissolved in November 2015. The documents of Mossack Fonseca prove that the former president of BIV also acquired in July 2011 company Gran Rex Alliance, registered in Panama on May 11, 2010, with an authorized capital of 10 thousand dollars, divided into 10 thousand shares of one dollar to bearer. In this case, the papers show that the Uruguayan law firm Estudio Posadas & Vecino Consultores Internacionales transferred to Mossack Fonseca all the documents related to the origin of the company. It was not possible to contact González Dellán for this work. Sources consulted indicate, however, that he lives in Europe. In 2012, celebrity magazines extensively reviewed his wedding in Las Vegas, USA, with the former miss and Venezuelan model, Aida Yéspica. The articles refer to the former president of BIV as a "Venezuelan lawyer" without major references, but they do show the photos of the marriage, as well as others disclosed by his wife in the social media, where they appear enjoying heavenly places like Saint Tropez, Balearic Islands, and Sicily.

Adrián Perdomo Mata has just entered the list of sanctioned entities of the US Department of the Treasury, as president of Minerven, the state company in charge of exploring, exporting and processing precious metals, particularly gold from the Guayana mines. His arrival in office coincided with the boom in exports of Venezuelan gold to new destinations, like Turkey, to finance food imports. Behind these secretive operations is the shadow of Alex Saab and Álvaro Pulido, the main beneficiaries of the sales of food for the Local Supply and Production Committee (Clap). Perdomo worked with them before Nicolás Maduro placed him in charge of the Venezuelan gold.

Gassan Salama, a Palestinian-cause activist, born in Colombia and naturalized Panamanian, frequently posts messages supporting the Cuban and Bolivarian revolutions on his social media accounts. But that leaning is not the main sign to doubt his impartiality as an observer of the elections in Venezuela, a role he played in the contested elections whereby Nicolás Maduro ratified himself as president. In fact, Salama, an entrepreneur and politician who has carried out controversial searches for submarine wrecks in Caribbean waters, found his true treasure in the main social aid and control program of Chavismo, the Clap, for which he receives millions of euros.

While the key role of Colombian entrepreneurs Alex Saab Morán and Álvaro Pulido Vargas in the import scheme of Nicolás Maduro’s Government program has come to light, almost nothing has been said about the participation of the traders who act as suppliers from Mexico. These are economic groups that, even before doing business with Venezuela, were not alien to public controversy.

Even though there are new brands, a new physical-chemical analysis requested by Armando.Info to UCV researchers shows that the milk powder currently distributed through the Venezuelan Government's food aid program, still has poor nutritional performance that jeopardizes the health of those who consume it. In the meantime, a mysterious supplier manages to monopolize the increasing imports and sales from Mexico to Venezuela.

Turkey and the coastal emirates of the Arabian Peninsula are now the homes of companies that supply the main social -and clientelist- program of the Government of Venezuela. Although the move from Mexico and Hong Kong, seems geographically epic, the companies has not changed hands. They are still owned by Colombian entrepreneurs Alex Nain Saab Morán and Álvaro Pulido Vargas, who control since 2016 a good part of the Import of food financed with public funds. Around the world for a business.

Since the borders to Colombia and Brazil are packed and there is minimal access to foreign currency to reach other desirable destinations, crossing to Trinidad and Tobago is one of the most accessible routes for those in distress seeking to flee Venezuela. Relocating them is the business of the 'coyotes' who are based in the states of Sucre or Delta Amacuro, while cheating them is that of the boatmen, fishermen, smugglers and security forces that haunt them.

When Vice President Delcy Rodríguez turned to a group of Mexican friends and partners to lessen the new electricity emergency in Venezuela, she laid the foundation stone of a shortcut through which Chavismo and its commercial allies have dodged the sanctions imposed by Washington on PDVSA’s exports of crude oil. Since then, with Alex Saab, Joaquín Leal and Alessandro Bazzoni as key figures, the circuit has spread to some thirty countries to trade other Venezuelan commodities. This is part of the revelations of this joint investigative series between the newspaper El País and Armando.info, developed from a leak of thousands of documents.

Leaked documents on Libre Abordo and the rest of the shady network that Joaquín Leal managed from Mexico, with tentacles reaching 30 countries, ―aimed to trade PDVSA crude oil and other raw materials that the Caracas regime needed to place in international markets in spite of the sanctions― show that the businessman claimed to have the approval of the Mexican government and supplies from Segalmex, an official entity. Beyond this smoking gun, there is evidence that Leal had privileged access to the vice foreign minister for Latin America and the Caribbean, Maximiliano Reyes.

The business structure that Alex Saab had registered in Turkey—revealed in 2018 in an article by Armando.info—was merely a false start for his plans to export Venezuelan coal. Almost simultaneously, the Colombian merchant made contact with his Mexican counterpart, Joaquín Leal, to plot a network that would not only market crude oil from Venezuelan state oil company PDVSA, as part of a maneuver to bypass the sanctions imposed by Washington, but would also take charge of a scheme to export coal from the mines of Zulia, in western Venezuela. The dirty play allowed that thousands of tons, valued in millions of dollars, ended up in ports in Mexico and Central America.

As part of their business network based in Mexico, with one foot in Dubai, the two traders devised a way to replace the operation of the large international credit card franchises if they were to abandon the Venezuelan market because of Washington’s sanctions. The developed electronic payment system, “Paquete Alcance,” aimed to get hundreds of millions of dollars in remittances sent by expatriates and use them to finance purchases at CLAP stores.

Scions of different lineages of tycoons in Venezuela, Francisco D’Agostino and Eduardo Cisneros are non-blood relatives. They were also partners for a short time in Elemento Oil & Gas Ltd, a Malta-based company, over which the young Cisneros eventually took full ownership. Elemento was a protagonist in the secret network of Venezuelan crude oil marketing that Joaquín Leal activated from Mexico. However, when it came to imposing sanctions, Washington penalized D’Agostino only… Why?

Through a company registered in Mexico – Consorcio Panamericano de Exportación – with no known trajectory or experience, Joaquín Leal made a daring proposal to the Venezuelan Guyana Corporation to “reactivate” the aluminum industry, paralyzed after March 2019 blackout. The business proposed to pay the power supply of state-owned companies in exchange for payment-in-kind with the metal.