The former Vice President of Finance and director of the state oil company was one of the executives in the industry with more charges and accusations. In 2006, the Office of the Comptroller opened a proceeding against him for not filing the sworn statement of assets. In 2011, he became noticeable for his alleged participation in the Ponzi scheme of Francisco Illaramendi. In 2009, four years after having him as a client, Mossack Fonseca learned that he was a Politically Exposed Person, but maintained the business relationship because no "links to illegal activities" were found.

|

Getting your Trinity Audio player ready...

|

Among the arguments that Ramón Fonseca, partner of the Mossack Fonseca law firm, which was victim of a massive leak of its communications, unveiled by the International Consortium of Journalists on Sunday, April 3, uses to defend himself is the adherence to the procedures established in the laws of Panama to open companies in tax havens and in the full background checks of their potential clients.

The case of Pdvsa former Vice President of Finance, Eudomario Carruyo, shows that doubts arose in the company whenever a Politically Exposed Person (PEP) knocked on the door, and the time elapsed before any irregularity was noticed.

In September 2005, just four months after one of his sons, Eudo, crashed a 2004 Lamborghini valued at more than 174 thousand dollars, in an avenue in Miami, USA, the Panamanian law firm began the proceedings to register the opening and registration of a company on behalf of Eudomario Carruyo, the subscription of powers and management of accounts that involved Switzerland, Panama and the British Virgin Islands.

Carruyo was then one of the top figures of the oil industry personnel who had survived the dismissal of over 20,000 of their workers after the stoppage of activities from December 2002 to February 2003. But after that accident, where the person accompanying his son died, and for which he had to pay a $ 100 thousand bail, rumors of the participation of the vice president of Finance in the payment to suppliers and placement of money in national and international banks began to go round in the headquarters of Pdvsa in Caracas. A former oil industry employee said about Carruyo’s time at the headquarters of PDVSA, "His ambition and lack of scruples left a bad image."

On September 16, 2005, Mossack Fonseca registered in British Virgin Islands (BIV) a company called Ozark Investment Corp, with a capital of 50 thousand dollars and 50 thousand shares issued at one dollar each. Twelve days later, from the Trusban office in Geneva, Switzerland, André Housman, a representative of that bank entity operating in tax havens, requested to include his client, Eudomario Carruyo, as a representative of that newly registered firm. An attempt was made for the Swiss banker to explain this process, but he did not respond to the email sent.

Shortly after, the two directors of the shell company approve that Carruyo - recently appointed as the then acting director of PDVSA - had the authority to sign everything on behalf of Ozark. Carruyo did not only hold that position, he was also a director of Citgo, the US-based Venezuelan oil company, and the subsidiaries Deltaven and Pdvsa Marina. But he also wanted to run shell companies. He did not do it alone. Little by little, he included his wife, Nancy Perozo, his children Eudo and Carlos, and even a person named Juan Carlos Linares Perozo. In August 2007, all the Carruyos had powers to manage the firm.

That same month of 2007, Housman requested certificates for two different companies for Eudomario Carruyo and Juan Montes. Montes was a director of Investments of PDVSA, a subordinate of the Vice President of Finance, responsible for the placement of money from the funds of pensioners and retirees of the state oil company. According to the prosecutors of the case against the Venezuelan-American Francisco Illaramendi, accused of participating in a Ponzi scheme to defraud almost 500 million dollars to retirees and pensioners of PDVSA, Montes received bribes from Illaramendi. The US authorities called him to testify. He reached an agreement to cooperate with justice and was released from a custodial sentence.

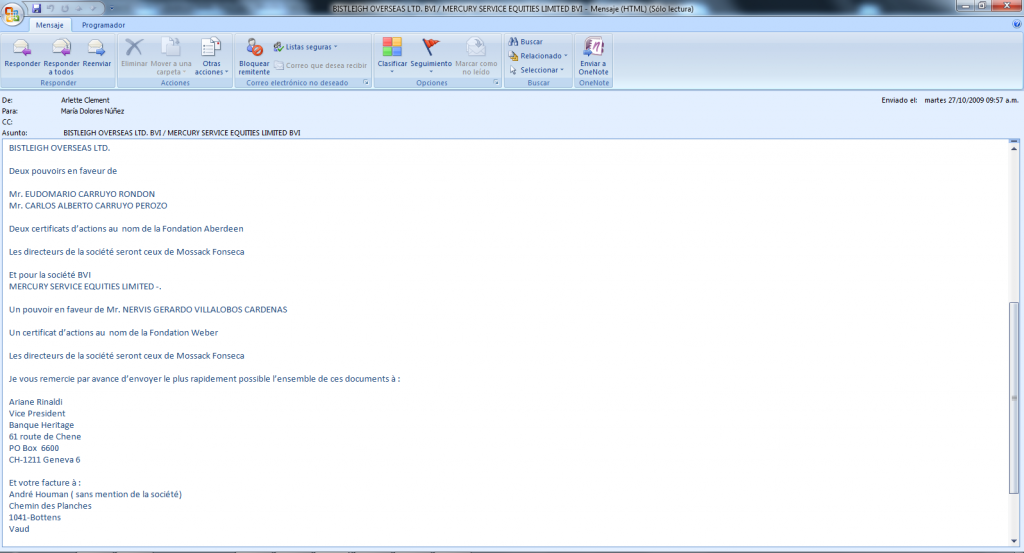

In 2009, with the authorization of the founders and shareholders of Mossack Fonseca, all the controls were cheated. On October 27 of the same year, Housman requested again that Carruyo be given powers to run the company, again a shell company, registered in Virgin Islands, Bistleigh Overseas LTD. Incidentally, that same day he requested once more, to transfer another firm, Mercury Limited Service, to the former Vice Minister of Electric Power, Nervis Villalobos, who left the government for corruption allegations and is among the former employees accused of having laundered money through of the Private Bank of Andorra.

Two days later, on October 29, after four years as a client of the firm founded in Panama, Mossack Fonseca warned that Carruyo was a Politically Exposed Person (PEP).

The office in Switzerland was alerted from the isthmus, and they did not take long to respond: "A client has requested powers for a person who appears as PEP, but who holds no political position. He only works in Petróleos de Venezuela S.A., which apparently is a government-related organization, but this person does not hold any political office... Please give your consent or not to issue the power. The customer, by the way, is not happy (as always happens with these issues)." From Panama they responded, "We have not found any information that relates Mr. Carruyo with illegal acts".

However, the doubt seems to have offended the still Vice President of Finance, which caused Trusban to desist from the interest of acquiring power for his client. To demonstrate how the process of creating and assigning companies works, two months later, Bistleigh Overseas LTD would change hands. This time, a mechanical engineer of Azerbaijan would be in charge.

The setback did not stop the Carruyos from being in control of Ozark, the company registered in 2005. But at the insistence of members of Mossack Fonseca, who wanted to obtain more accurate information about the company's activities, it would be up to the family counselor to admit that "the activity of Ozark is the opening of a bank account in Switzerland."

A year later, in May 2013, the Carruyos would sign an agreement with Banque Heritage, the same entity from which Nervis Villalobos also did business. Once again, Housman would give a key answer in view of the insistence of the staff of Mossack Fonseca to obtain more than general information, "the company papers are in Venezuela".

A top manager says that Eudomario Carruyo had a good relationship with Diego Salazar, cousin of Rafael Ramírez, insurance and reinsurance broker of PDVSA, and mentioned in the case of money laundering through the Private Bank of Andorra.

In 2006, the Comptroller General of the Republic brought an action against him for not filing his sworn statement of assets, which was transferred to the Public Prosecutor's Office. That case appears in the annual report of the Prosecuting Attorney's Office of 2008, but does not detail results. The Office of the Comptroller has not penalized him yet.

In

addition, he is accused of being one of the persons in charge - following higher

orders – of providing money from PDVSA for the financing of national or

international electoral campaigns, such as Cristina Kichner's, in Argentina. "It

was not a suitcase; there were six suitcases sent with money. But they only

captured Guido Antonini Wilson," says one interviewee when recalling the arrest

of a Venezuelan businessman in Buenos Aires in August 2007, who a suitcase with

$ 800,000 in cash. It is stated that Carruyo also participated in the

plot.

When he was dismissed on May 26, 2011, by order of the then President Hugo Chávez, apparently no one celebrated in La Campiña, the main headquarters of the oil company located in eastern Caracas, but more than one took a deep breath. Many knew about the capers of Carruyo and his sons Eudo and Carlos in Pdvsa. "They were extremely shameless. None of the things said about them was a surprise… that they did that business. It was a common matter to hear stories of the three of them in the building," says an executive of the state oil company that was close to them, who recalls that Eudo Carruyo, the eldest son, was an external planning advisor, while Carlos, the youngest, worked in the PDVSA audit area. The eldest was the one who drew more attention.

Carruyo, a public accountant graduated from Universidad del Zulia, had a long career in PDVSA that began in the '70s. From 1992 to 1997, he was director of Palmaven, a subsidiary of Pequiven. In 1999, he would be part of the main team of auditors of the industry accounts, a position he held until 2002. Three years later, he would not only be appointed acting director, but also director of Citgo, Deltaven, Pdvsa Marina and Vice President of Finance, a position he held until his dismissal due to the Illaramendi case.

In 2011, exactly 15 days before Chávez dismissed him, Carruyo issued his last public statement. It was a letter sent to the National Assembly, where he denied that the PDVSA board was responsible for the loss of $ 453 million in the fraudulent Ponzi scheme mounted by Illaramendi, who, he said, worked for the state company in 2004. He also reported that the state oil company would be responsible for covering the lost funds.

Since then, nothing else has been heard from him, either orally or in writing. He went into ostracism, despite the fact that, according to the database of the Venezuelan Institute of Social Security, he worked at PDV Marina until March 2015. People who know him say that he spends a lot of time in La Romana, Dominican Republic, aboard a yacht acquired by his son, where he offers dinners with luxurious tableware purchased in Miami or New York. Despite of the efforts find him through PDVSA or old colleagues, he could not be located to ask him to give us an interview for this report.

His children, particularly Eudo, continue carrying out different types of business activities, both in Venezuela and abroad. However, he cannot return to the US, because he fled from the justice of that country after causing the death of his companion in the 2005 car accident. In addition to a debt with the US judicial system, he owed over $ 182,000 to Jackson Memorial Hospital, where he was treated after the crash. He only paid the bill after a lawsuit in December 2005. People who have worked with them identify them as importers of prefabricated houses to cover Petrocasa's deficit, among other products. It was also impossible to contact the brothers.

In Panama, the eldest of the Carruyo Perozo registered company Bluenor International, and Douglas Cosentino - an entrepreneur in the footwear sector of the West of Caracas - is a partner who, in photographs posted on Twitter, poses next to sports cars, a plane and a yacht. We called to the headquarters of Creaciones Hermanos Cosentino, located in Catia, to ??contact the Carruyos, but there was no response.

As to Juan Carlos Linares Perozo, there is little information available. According to the Dateas.com database, there is only one person with that name in Venezuela. The Social Security indicates that he works at Tecnoconsult, but a telephone operator from the engineering consulting company said that he did not appear in the internal record. We sent a message to his alleged Facebook account to try to contact him, but there was no response.

For the time being, the documents of Mossack Fonseca remain as samples of the operations carried out through Panama, the British Virgin Islands and Switzerland, the latter being the country where the judicial authorities announced during the Holy Week that 18 banks will support USA in the investigation of money laundering through PDVSA accounts. Therefore, they will deliver the bank records. Then, perhaps, there will be fortunes that may not be concealed.

Since its opening in 2017, the Porsche Design Tower quickly became a symbol of luxury and ostentation in South Florida. Magnates from all over the world retreat behind the discretion of its tinted glass windows and virtually anonymous legal entities. But in recent days, two police investigations into illegal financial flows from abroad placed the building under an inconvenient spotlight. The justice just seized an apartment of over five million dollars from a Venezuelan agent.

As if they were pieces of a broken mirror scattered in many islands around the world, several offshore companies form an oil-trading business network that reveals the trajectory of Alessandro Bazzoni and Francisco D'Agostino. Both of them, together with the Venezuelan telecommunications magnate Oswaldo Cisneros, landed in 2016 in the Orinoco Belt to fill the vacancy of the original partner, Harvest Natural Resources.

Aside from ethical questions, the logic of a private entity opening an offshore company seems elementary —to declare its profits in a territory where it can pay less tax than it should in its place of origin. But when it comes to a state-owned company like Petróleos de Venezuela, which is not obliged to pay taxes - and therefore does not need to evade them - it is difficult to understand why within its business scheme there is contracting with companies established in tax havens and there is even the creation of their own subsidiaries in these places. What does the Venezuelan public treasury gain from this?

The member of the US Cabinet, Wilbur Ross, is one of the owners of a company that provides maritime transport services to Pdvsa, a client that in 2015 contributed over 11 percent of the profits to his shipping company. Although the official had to get rid of his mercantile properties to hold his position, he kept a participation in that line of business through a complex offshore structure in the Cayman Islands. Thus, he did not only do business with chavista Venezuela, but also with an associate of Russian President Vladimir Putin. Both countries are subject to economic sanctions by Washington.

Pequiven, a subsidiary of Petróleos de Venezuela, sought shelter in tax havens to legalize its association with Iranian company National Petrochemical Company, from which Veniran emerged. Although the Panamanian law firm was suspicious of the alliance between the then presidents Hugo Chávez and Mahmud Ahmadinejad, it finally solved the inconvenience to please both clients.

Leonardo González Dellán headed Banco Industrial de Venezuela (BIV) from 2002 to 2004. The papers of Mossack Fonseca reveal that, in this period, which also coincided with the establishment of the exchange control and the birth of the extinct Cadivi, he was related to overseas companies.

When Vice President Delcy Rodríguez turned to a group of Mexican friends and partners to lessen the new electricity emergency in Venezuela, she laid the foundation stone of a shortcut through which Chavismo and its commercial allies have dodged the sanctions imposed by Washington on PDVSA’s exports of crude oil. Since then, with Alex Saab, Joaquín Leal and Alessandro Bazzoni as key figures, the circuit has spread to some thirty countries to trade other Venezuelan commodities. This is part of the revelations of this joint investigative series between the newspaper El País and Armando.info, developed from a leak of thousands of documents.

Leaked documents on Libre Abordo and the rest of the shady network that Joaquín Leal managed from Mexico, with tentacles reaching 30 countries, ―aimed to trade PDVSA crude oil and other raw materials that the Caracas regime needed to place in international markets in spite of the sanctions― show that the businessman claimed to have the approval of the Mexican government and supplies from Segalmex, an official entity. Beyond this smoking gun, there is evidence that Leal had privileged access to the vice foreign minister for Latin America and the Caribbean, Maximiliano Reyes.

The business structure that Alex Saab had registered in Turkey—revealed in 2018 in an article by Armando.info—was merely a false start for his plans to export Venezuelan coal. Almost simultaneously, the Colombian merchant made contact with his Mexican counterpart, Joaquín Leal, to plot a network that would not only market crude oil from Venezuelan state oil company PDVSA, as part of a maneuver to bypass the sanctions imposed by Washington, but would also take charge of a scheme to export coal from the mines of Zulia, in western Venezuela. The dirty play allowed that thousands of tons, valued in millions of dollars, ended up in ports in Mexico and Central America.

As part of their business network based in Mexico, with one foot in Dubai, the two traders devised a way to replace the operation of the large international credit card franchises if they were to abandon the Venezuelan market because of Washington’s sanctions. The developed electronic payment system, “Paquete Alcance,” aimed to get hundreds of millions of dollars in remittances sent by expatriates and use them to finance purchases at CLAP stores.

Scions of different lineages of tycoons in Venezuela, Francisco D’Agostino and Eduardo Cisneros are non-blood relatives. They were also partners for a short time in Elemento Oil & Gas Ltd, a Malta-based company, over which the young Cisneros eventually took full ownership. Elemento was a protagonist in the secret network of Venezuelan crude oil marketing that Joaquín Leal activated from Mexico. However, when it came to imposing sanctions, Washington penalized D’Agostino only… Why?

Through a company registered in Mexico – Consorcio Panamericano de Exportación – with no known trajectory or experience, Joaquín Leal made a daring proposal to the Venezuelan Guyana Corporation to “reactivate” the aluminum industry, paralyzed after March 2019 blackout. The business proposed to pay the power supply of state-owned companies in exchange for payment-in-kind with the metal.