The family of Lebanese origin and creator of Tiuna military vehicles is the one who really controls the assembly operation of the Chinese make cars. It is formally a "mixed company" that the Government qualifies as a "highly successful experience", used by the group to secure a majority share of access to the foreign currency of the business to import parts and assembly material through an offshore corporate structure.

|

Getting your Trinity Audio player ready...

|

The Chery car business is one that runs in Venezuela. Unlike the fate of other car makes in recent years, which have disappeared from the local market, the Chinese make cars are seen everywhere thanks to the support of the Government.

Last year alone, Nicolás Maduro announced the purchase of 20 thousand Chery taxis, an amount that exceeds the production of the seven private car assembly plants in 2015. Massive imports of the make began with Hugo Chávez, especially between 2010 and 2014. The former president was also a kind of supporter to start assembling Chery cars in the country.

Today, the initiative stands out as an example of collaboration between the public and private sectors. In March, Carlos Faría, Vice Minister of Industry, described it as an "emblematic project" and as "a highly successful experience". But what seems to be an example has been for the authorities - in financial terms - a juicy business for the Yammine group. The clan, headed by Sarkis Mohsen Yammine Leunkara, native of Lebanon, and Antonio José Yammine Saade and Mohsen Yammine Saade, born in Caracas and El Tigre, respectively, controls the operation.

The entrepreneurs are old acquaintances of the Government and the military world. They were in charge of carrying out the Tiuna project, a "multipurpose" car of their own stamp that makes the Venezuelan Armed Forces proud.

Now, the leaked papers of the Panamanian law firm Mossack Fonseca bare the plot behind the Chery business. The investors created in Hong Kong and other jurisdictions a corporate structure that allows withholding, in different “checkpoints” established between the Venezuelan operation and the head office in China, portions of the currencies related to the acquisition of auto parts and assembly material.

The Chery assembly in Venezuela began in 2011. "A Venezuelan private company that was willing to work with the Venezuelan Government and the Chinese company. Today, we are opening in Las Tejerías, state of Aragua, a car assembly plant," Chávez celebrated on August 25 of that year in a council of ministers. Laughing, while playing with two scale reproductions of the cars soon to be assembled, he said: "I was asked to give names to the cars. I chose Arauca for one and Orinoco for the other. These are Chery cars (...) these cars will be available in the Venezuelan market. They are excellent, beautiful and cheap."

Chávez summed up the alliance with Corporación Automotriz Z.G.T., which in September 2010 agreed to form a "joint venture" with the State. It was the birth of a deal that five years later, in the midst of the serious economic crisis and paralysis of the rest of the car companies, seems great.

Corporación Automotriz Z.G.T. was just the first piece of the business puzzle put together by the Yammines abroad. Oblivious to the development of socialism promoted by Chávez, a business structure had been devised to control the business, a kind of financial labyrinth that seems designed to conceal the beneficiaries.

According to the documents leaked from Mossack Fonseca, —received from an anonymous source by the Süddeutsche Zeitung of Munich and reviewed by a team of over 370 journalists worldwide under the coordination of the International Consortium of Investigative Journalists (ICIJ) — the Yammine have put some effort in leaving no traces of them in the corporate network that have been built in tax havens like Hong Kong, Panama and the Seychelles.

To begin to unravel the skein it is worth quoting an email that Jahrold Maizo, vice president of Corporación Automotriz Z.G.T. and related to the Yammine, sent on May 31, 2010 to his counterparts, executives of Mossack Fonseca in Panama.

"We are in the process of organizing a company in Hong Kong, in which the sole shareholder will be Chery Andean and Caribbean, with directors appointed by AFRA (another Panamanian law firm). Therefore, we need these directors to sign the deed of incorporation. I am sending you the necessary documents (...) On the other hand, after the incorporation of the company in Hong Kong, and in order to keep all our companies under one law firm and close to our corporate office, we require companies Ematrade Inc and Chery Andean & Caribbean Inc to be transferred to Mossack Fonseca y Compañía," Maizo wrote.

The communication reveals how the Chery operation in Venezuela was forged. The company which Maizo refers to is ICA International Automobiles Limited, registered in Hong Kong on June 1, 2010, under number 1463140. The memorandum of association indicates that the initial capital was 10,000 Hong Kong dollars, divided into 10,000 shares, at the rate of one dollar per share.

The directors of that company are Genesis Ltd and Finas Ltd, two companies registered by Mossack Fonseca in the jurisdiction of the Seychelles. The service of the law firm includes appointing the people who act as directors of these companies, which allows concealing who is behind ICA International Automobiles Limited. But the identities were revealed by one of the leaked documents, a "power of attorney" issued by the ICA board that "can be used and enforced individually by Antonio Yammine, Mohsen Yammine, and Sarkis Yammine, anywhere in the world, including any country, state, colony, province, municipality or political subdivision of any country."

Chery Andean & Caribbean, a company registered in Panama, is the sole shareholder of ICA International Automobiles Limited, as evidenced by a "certificate" of July 22, 2010. It was "registered" on May 28, 2009, according to "public deed number 4640" of the twelfth notary of the circuit of Panama.

The articles of incorporation state that it was organized by Panamanians Camilo Andrés Méndez Chong and Brunilda Gabriela Broce with an "authorized capital" of 10,000 US dollars, divided into 10,000 shares. On June 2, 2009, they both signed a "minute of the Board’s meeting" in which they resolved to "issue 10,000 shares of the company’s authorized capital to Ematrade Inc," another link were Antonio, Mohsen and Sarkis Yammine are related to, each with 33.33% of the shares of that company that was also registered in Panama.

A beneficial owner declaration, part of the file of Mossack Fonseca, and signed by Antonio Yammine, summarizes the plot. ICA Intenational Automobiles Limited is a company registered in Hong Kong, whose sole shareholder is Chery Andean & Caribbean, registered in Panama, and the "real beneficiaries" or of which are the Yammines. However, none of the Yammines wanted to give an answer about this set-up. Attempts were made to contact executives of Corporación Automotriz Z.G.T, ICA International Automobiles Limited, the Ministry of Industries and the Yammine group for this investigation, but they were not available.

The structure set in Hong Kong and Panama allows the group to control a good part of the business, although the Venezuelan operation appears in the papers as a joint venture between the Venezuelan State and Corporación Automotriz Z.G.T.

ICA International Automobiles Limited - and not company Chery, as it may believed - dispatches the assembly material and auto parts of the Chinese make for Corporación Automotriz Z.G.T. In other words, the Hong Kong company, whose beneficiaries are the Yammines, works as a trader between Chery's parent company and the Venezuelan joint venture, even though it is an operation that works under the Chinese Fund scheme, where the Government usually pays directly for the merchandise to the supplier in China, and despite the resistance of the Venezuelan authorities to the existence of intermediary chains in the private business activity.

Reports of the Puerto Cabello port movement, prepared by the Chamber of Commerce of that town, reveal that just between late 2014 and this year, ICA International Automobiles Limited appeared as the "shipper" in at least 16 shipments of assembly material from the ports of Wuhu and Shanghai in China, the "addressee" of which in Venezuela was Corporación Automotriz Z.G.T.

Other invoices show that ICA International Automobiles Limited bought spare parts and auto parts from Wuhu Chery Automobile Service Parts Co Ltd, a subsidiary of Chery's parent company. In 2014 alone, based on 40 invoices from that year, the company acquired spare parts worth $ 3.6 million.

The control of ICA International Automobiles Limited over Chery's business in Venezuela is also evident in the company's financial reports. As of December 31, 2014, the debt of Corporación Automotriz Z.G.T. - the private partner of the Government in the joint venture with ICA International Automobiles Limited (the Yammines’ company in Hong Kong) - amounted to almost 169 million dollars, according to a document of June 29, 2015.

In practice, the business plot works like a string of tolls in which portions of the dollars involved in the Chery business are withheld. ICA International Automobiles Limited (the Yammines’ company in Hong Kong) must pay a percentage of the income of Chery Andean & Caribbean (the Yammines’ company in Panama) , as a shareholder, and pay for "commission", "warranty" of the cars, "technology transfer" and "technical assistance".

Financial reports reveal that from 2011 to 2014, ICA International Automobiles (a company opened with $ 10,000 of capital in Hong Kong) paid Chery Andean & Caribbean around $ 125 million for its shareholder role, almost a quarter of the turnover - almost 565 million dollars - that the company registered in those years for the sale of Chery products to Venezuela.

The payments for "commission", "warranty", "technical assistance" and "technology transfer" by ICA International Automobiles Limited to Chery Andean & Caribbean – i.e. again, from a Yammines’ company in Hong Kong to another in Panama - totaled another 70 million dollars from 2011 to 2014. The documents of Mossack Fonseca include the contracts between both companies for these services. "ICA International Automobiles Limited agrees to pay a commission to Chery Andean & Caribbean for each car sold according to a fee schedule established by both parties," read the technology transfer, technical assistance and warranty service agreements.

Chery Andean & Caribbean is in turn committed to guarantee that operations in the "manufacturing plants of ICA International Automobile Limited or its subsidiaries" are carried out as best as possible, which reveals the logic of the business: although the assembly of Chery corresponds to a joint venture, it seems that the operation is a private matter, especially of the Yammines.

Other invoices show that in 2014, ICA International Automobiles Limited paid a company domiciled in Venezuela, nearly 10 million dollars for the transport of merchandise containers from Puerto Cabello to the facilities of the joint venture in Las Tejerías.

There have also been transfers from the bank accounts of ICA International Automobiles Limited to other companies registered in Panama, the British Virgin Islands and Florida, USA, some of them also associated with the Yammines, as revealed by the leak of Mossack Fonseca.

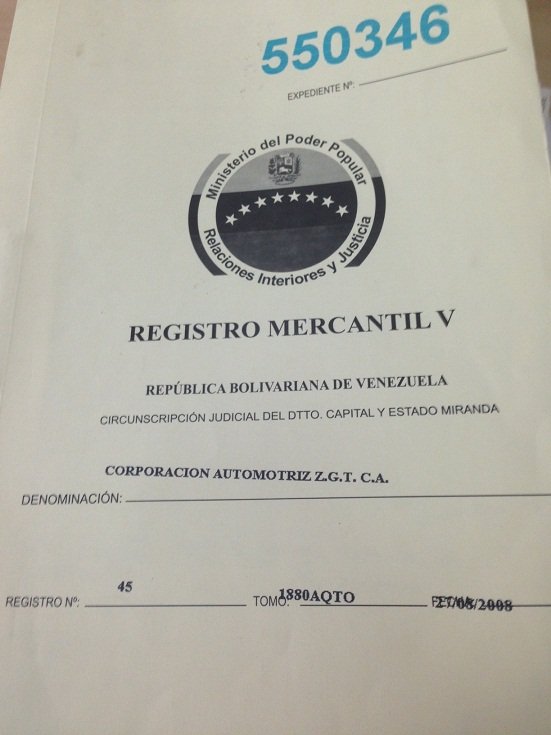

Corporación Automotriz Z.G.T. was registered on August 27, 2008, in the Fifth Commercial Registry of the judicial district of the Capital District and State of Miranda. Ramón Dahdah Galeb and Juana Francisca Revete are the shareholders of a company that was born with a capital of 2.3 million bolivars. Dahdah Galeb, entrepreneur of Lebanese origin like the Yammines, controls 70% of the shares, and Revete holds the remaining 30%.

From 2004 to 2011, Corporación Automotriz Z.G.T. received $ 3,568,039 from the former Foreign Exchange Administration Commission (Cadivi). The Yammines do not appeared in the shareholding structure, but several indications show the influence and control of the group over Corporación Automotriz Z.G.T.

Jahrold Maizo, director of Corporación Automotriz Z.G.T. who exchanged emails with the Mossack Fonseca law firm to define the structure of the business, worked with the Yammines at the Centro Nacional de Repotenciación (Cenareca), a company with which the group made incursions in 2004 into the assembly of the Tiuna car for the Armed Forces, which obtained between 2004 and 2011 another $ 3,204,759 through Cadivi.

Since 2008, Cenareca has 49% of the shares in Empresa Mixta Socialista de Vehículos Venezolanos (Emsoven), and Compañía Anónima Venezolana de Industrias Militares (Cavim) has the remaining 51%. ICA International Automobiles Limited, the company registered in Hong Kong that dispatches the products to assemble the Chery car, is also the company that sells the assembly material to Emsoven.

The two shareholders of Corporación Automotriz Z.G.T. also have some kind of relationship with Cenareca and Emsoven. In the National Registry of Contractors (RNC), Ramón Dahdah Galeb appears as "contact person" of Emsoven in an "acquisition of accessories and auto parts" to a company called Metalpres Asociados 3000 C.A. In addition, transfers have been made from the bank accounts of ICA International Automobiles Limited to Dahdah Galeb, as revealed by the documents leaked from Mossack Fonseca.

For her part, Juana Francisca Revete, appears as a worker of Cenareca since November 1, 2004, according to the Venezuelan Institute of Social Security (IVSS).

But there is more. A press release from the Ministry of Industries, dated March 18, 2014, refers to Antonio Yammine as "director" of Corporación Automotriz Z.G.T. "The Yammines appear everywhere, their name resonates, but Dahdah Galeb only appears on paper," says a former manager, who preferred to reserve his identity.

Antonio Yammine also acknowledged that Corporación Automotriz Z.G.T. was "under his control" when he began negotiations to buy a second assembly plant for Chery in the state of Carabobo in May 2013. The property was intended to build cars of another Chinese make, Great Wall, and belonged to company Ensamblaje Superior C.A. The Yammines paid 5 million dollars, divided into two payments, and agreed to pay another 11 million dollars by a letter of credit, issued by the Interaudi bank, which would expire on December 17, 2014.

However, on July 30, 2013, a presidential decree was published in the Extraordinary Official Gazette 6.108, whereby "movable, immovable and improvements that serve for company Great Wall de Venezuela and its subsidiary companies to operate are affected." After that measure, the Yammines and the Interaudi bank suspended the letter of credit to the owners of the facility, which led to a legal dispute in the USA against ICA International Automobiles Limited and the Interaudi bank.

Sources related to the car industry expressed their suspicions that the expropriation was made to favor the Yammines, Corporación Automotriz Z.G.T. and the Chery operation, since a few days after that measure, on August 1, 2013, another presidential decree appeared in Official Gazette 40.219 to create the joint venture "Chery de Venezuela C.A.", in which the State owns 51% of the shares and Corporación Automotriz Z.G.T. owns the other 49%.

The growth of the Yammine group has not stopped. At the end of last year, they completed another plan that already places them as the most important businessmen of the Venezuelan car industry, an area that contributes 3.5% of the Gross Domestic Product.

In December 2015, the Yammines bought MMC Automotriz from the Japanese Sojitz Group to take over the assembly and license in the local market of car makes, like Mistubishi, Hyundai and Fuso. The negotiation was handled with confidentiality, and the identity of the buyers was not revealed. Though this year, Antonio Yammine showed up at the company's headquarters in Caracas and at the plant located in the industrial zone of Barcelona, ??state of Anzoátegui (northeast of Venezuela).

Sources close to the negotiation assure that the scheme followed by the Yammines is similar to the scheme used in Chery, since the purchase was made through a company registered in Hong Kong. Internally, MMC Automotriz barely reported in a brief statement that the company had acquired Grupo Sylca, with "over 30 years of experience and confidence in the development of the country.” That is how the Yammines tried to go unnoticed, but Sylca is a company registered in Florida, USA, over which they also have control, the address of which is the same as the address of other companies of the group registered in that state, and which - based on the documentation of Mossack Fonseca - has received funds from ICA International Automobiles Limited.

In the industry the purchase is interpreted as the leap of the group to the "big leagues" of the car industry and another example of the power they have accumulated in a context where even the subsidiaries of transnational companies like Chrysler, Ford, General Motors or Toyota teeter due to the lack of foreign exchange and the obstacles to operate in the country.

Pequiven, a subsidiary of Petróleos de Venezuela, sought shelter in tax havens to legalize its association with Iranian company National Petrochemical Company, from which Veniran emerged. Although the Panamanian law firm was suspicious of the alliance between the then presidents Hugo Chávez and Mahmud Ahmadinejad, it finally solved the inconvenience to please both clients.

Leonardo González Dellán headed Banco Industrial de Venezuela (BIV) from 2002 to 2004. The papers of Mossack Fonseca reveal that, in this period, which also coincided with the establishment of the exchange control and the birth of the extinct Cadivi, he was related to overseas companies.

The last two major global investigations conducted by the International Consortium of Investigative Journalists revealed the offshore business of Eligio Cedeño, a former Venezuelan banker considered a fugitive from justice by some and politically persecuted by others. Company Cedel International Investment, owner of Bolívar Banco and Banpro, also requested the services of Mossack Fonseca to operate in the British Virgin Islands.

The name of the former head of the Venezuelan oil company in Colombia appears in the papers of Mossack Fonseca with 100% of the shares of a company created in June 2011, of which she requested to be dissolved six months later. She is unemployed since August 2015, when she was replaced by the ex-sister-in-law of President Nicolás Maduro

The so-called "insurance tsar" opened four offshore companies in a Caribbean island through the Panamanian law firm Mossack Fonseca. Corporación OFL, which consists of about 20 companies in his name, makes him one of the entrepreneurs in the insurance sector that has grown the most during the chavista government.

The ex-banker used the services of the Panamanian law firm Mossack Fonseca to register companies in tax havens while he was being tried in Venezuela by his ex-colleagues from the Stanford Group. He said he was a victim of chavism to be accepted as a client and thus protect his fortune.

When Vice President Delcy Rodríguez turned to a group of Mexican friends and partners to lessen the new electricity emergency in Venezuela, she laid the foundation stone of a shortcut through which Chavismo and its commercial allies have dodged the sanctions imposed by Washington on PDVSA’s exports of crude oil. Since then, with Alex Saab, Joaquín Leal and Alessandro Bazzoni as key figures, the circuit has spread to some thirty countries to trade other Venezuelan commodities. This is part of the revelations of this joint investigative series between the newspaper El País and Armando.info, developed from a leak of thousands of documents.

Leaked documents on Libre Abordo and the rest of the shady network that Joaquín Leal managed from Mexico, with tentacles reaching 30 countries, ―aimed to trade PDVSA crude oil and other raw materials that the Caracas regime needed to place in international markets in spite of the sanctions― show that the businessman claimed to have the approval of the Mexican government and supplies from Segalmex, an official entity. Beyond this smoking gun, there is evidence that Leal had privileged access to the vice foreign minister for Latin America and the Caribbean, Maximiliano Reyes.

The business structure that Alex Saab had registered in Turkey—revealed in 2018 in an article by Armando.info—was merely a false start for his plans to export Venezuelan coal. Almost simultaneously, the Colombian merchant made contact with his Mexican counterpart, Joaquín Leal, to plot a network that would not only market crude oil from Venezuelan state oil company PDVSA, as part of a maneuver to bypass the sanctions imposed by Washington, but would also take charge of a scheme to export coal from the mines of Zulia, in western Venezuela. The dirty play allowed that thousands of tons, valued in millions of dollars, ended up in ports in Mexico and Central America.

As part of their business network based in Mexico, with one foot in Dubai, the two traders devised a way to replace the operation of the large international credit card franchises if they were to abandon the Venezuelan market because of Washington’s sanctions. The developed electronic payment system, “Paquete Alcance,” aimed to get hundreds of millions of dollars in remittances sent by expatriates and use them to finance purchases at CLAP stores.

Scions of different lineages of tycoons in Venezuela, Francisco D’Agostino and Eduardo Cisneros are non-blood relatives. They were also partners for a short time in Elemento Oil & Gas Ltd, a Malta-based company, over which the young Cisneros eventually took full ownership. Elemento was a protagonist in the secret network of Venezuelan crude oil marketing that Joaquín Leal activated from Mexico. However, when it came to imposing sanctions, Washington penalized D’Agostino only… Why?

Through a company registered in Mexico – Consorcio Panamericano de Exportación – with no known trajectory or experience, Joaquín Leal made a daring proposal to the Venezuelan Guyana Corporation to “reactivate” the aluminum industry, paralyzed after March 2019 blackout. The business proposed to pay the power supply of state-owned companies in exchange for payment-in-kind with the metal.