After making friends with chavista and opposition politicians, the brothers Leopoldo and Andrés Castillo Bozo were charged in 2009 by the Venezuelan Prosecutor for the crime of identity theft to buy public debt bonds. The Panama Papers revealed that at the time, the owners of Grupo Banvalor had three companies in the Virgin Islands, in addition to 22 more companies distributed in the United States of America, Aruba, the Dominican Republic, and Panama. Never had a flight been so well secured.

|

Getting your Trinity Audio player ready...

|

On March 4, a brief statement was sent to the customers of BBA Bank N.V. in Aruba. The owners reported that they had made the decision to liquidate the entity by July 15. "The bank faced several challenges in the environment of the international financial community that blocked its growth. Other personal issues also played a role in the voluntary decision to suspend the bank's operations." They promised to return the customers, mostly Venezuelan, the money deposited before closing.

The event shook the island because, in addition, the US government denied a visa to one of the owners of the bank for alleged activities related to terrorism, according to the Venezuelan journalist based in Miami, Casto Ocando.

For the second time in less than five years, brothers Leopoldo and Andrés Castillo Bozo faced the forced closure of a financial enterprise.

Aruba was the port of disembarkation of the owners of Grupo Banvalor — made up by Corporación Castillo Beltrán C.A., Seguros Banvalor C.A., Banvalor Banco Comercial C.A., and Banvalor Casa de Bolsa C.A. — just a month after having been summoned in February 2009 by the Venezuelan Public Prosecutor’s Office, to charge them with the crimes of simulation of stock exchange operations, fraudulent acquisition of foreign exchange and conspiracy.

The event occurred when after the sale of bonds of PDVSA and the Republic in dollars, the Castillos designed, between 2006 and 2007, a scheme to have more dollars awarded. They made purchase requests on behalf of 1,000 employees, while they were allegedly unaware. After the complaint of those affected, the authorities discovered operational irregularities in the bank and the insurance company, including, an unusual illiquidity inexplicable for a group managing insurance contracts as coveted and millionaires as those of the Ministry of Education and several state governments.

The opening of the BBA Bank of Aruba was publicized as the first performance of the group in international operations. Former Prime Minister of Aruba, Nelson Oduber, and the then deputy of the Podemos party, Juan José Molina attended the opening. However, the Panama Papers reveal that the Castillo Bozo brothers already had a secret business structure in the Virgin Islands, made up of three companies. And what was thought to be the first step of an expansion towards Caribbean markets was simply the continuation of an offshore undertaking carried out in the past.

No commercial or administrative activity is known of any of the companies in the Virgin Islands. They were registered between 2003 and 2005, more than 10 years ago, just at the time when entrepreneurs skillfully navigated through the new waters of Venezuelan politics, led by Alfredo Peña, Juan Barreto, Eduardo Manuitt, and Aristóbulo Istúriz.

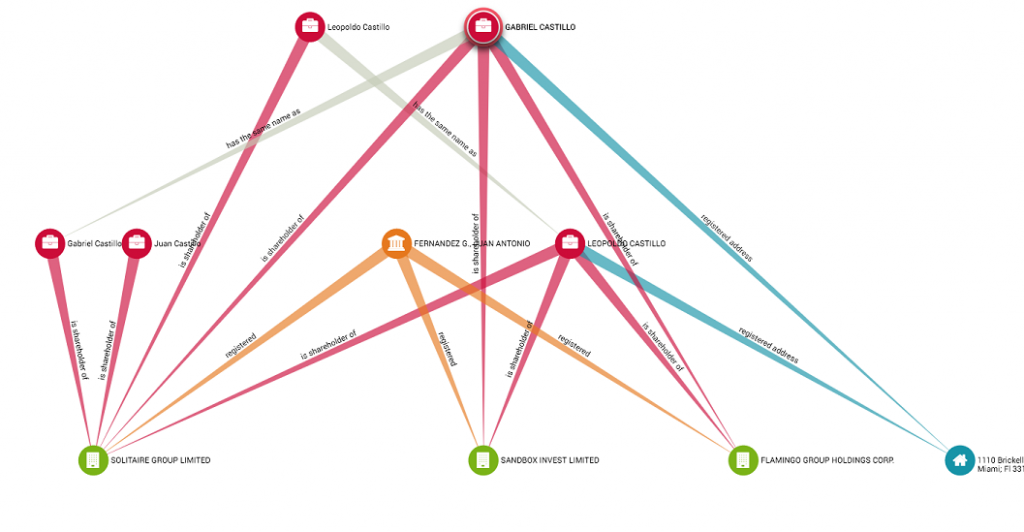

To create the offshore platform (outside of the Venezuelan jurisdiction), the Castillos used the services of the Mossack Fonseca law firm in Panama. With that leverage and expertise, Solitaire Group Limited, Flamingo Group Holdings Corp., and Sandbox Invest became a commercial base that the brothers maintained active until at least 2012, according to the law firm's documents, always with the same headquarters on Francis Drake Street in Road Town, the capital of Tortola, one of the Virgin Islands. The last two companies have "mirrors" (related companies with similar name) in Miami (United States), with the same headquarters and with unknown business activity.

Having set up a space abroad, possibly allowed them to quickly flee the country and settle abroad, when the Venezuelan Prosecutor's Office knocked on their doors.

The turning point to the Castillo Bozo brothers began in July 2007, when the Ministry of Education withdrew one of the most bulky policies, coveted by Venezuelan insurers.

The ministry had become the cornerstone of the financial group. "That insurance is one of the most lucrative in Latin America, because official deposits are received at a savings rate that insurers then place in a public market at a lending rate. The business is colossal," said economist Francisco Faraco. Specialists indicate that the amount of the policy was around 100 million dollars. The Castillo Bozos also had the policies of the government of Monagas, Miranda and Carabobo. At the best moment, Seguros Banvalor and Banvalor Bank had 4 million clients combined.

After that massive withdrawal, Seguros Banvalor did not recover. The employees of the entity filed a claim against the directors, the same as the subsidiary bank, Banvalor. Shortly after, in 2009, a financial mini-crisis exploded. "Those banks formed with Grupo Banvalor the operative platform of Alejadro Andrade, Treasurer of the Nation, in the purchase of Pdvsa bonds that were then traded in the black currency market, generating extremely high profits," added Faraco. The former treasurer, now in the United States of America, would have favored the group with direct awards of bonds and structured notes.

The withdrawal of the policy of the Ministry of Education and the subsequent allegations of identity theft of the employees seem to have been the necessary fuel for the group to move quickly from the country. A part of the new venture was made with stealth and the other with publicity. According to the Public Registry of Panama, from 2007 to 2010 (when Seguros Banvalor was intervened), the Castillo Bozos opened 13 companies, of which no business activity is known. One of them has a name similar to the other one in Delaware (USA), a state that receives large revenues through the registration of companies with tax facilities, and recognized worldwide as a tax haven. Two other operations received extensive publicity: the opening of Seguros BBA Corp. in Panama (2008) and the opening of BBA Bank of Aruba, registered as offshore with the Central Bank of the island and exclusively aimed at capturing dollars from Venezuelan customers (2009).

The 13 companies are Joycespace, Maida Enterprises, Beauty Corporation Inc., Kairos Asesores de Inversiones, Daltrey Properties Inc., Bowman Investment S.A., KYC Ltd S.A., MBH Ltd S.A., Hiven Consultants Inc., Twin Shine Corp, Dream Rock Corp, Teller Enterprises, and Mercury Star.

When Seguros Banvalor was intervened by the Venezuelan government in January 2010, neither Leopoldo nor Gabriel, the main directors, were in the country. Even with an Interpol alert on their backs, the network built since 2003 with the help of the Mossack Fonseca law firm gave them the security necessary to turn the page of the country and continue with the open face of the Caribbean expansion. From January 2010 to October 2013, Leopoldo and Gabriel Castillo Bozo opened 6 companies related to the insurance, banking and finance sector in Panama (Seguros BBA Corp. and Financiadora Inversolution), the Dominican Republic (Banco Atlántico and Atlántico CCA Valores) ,and even the United States of America (BBA Capital NYC).

Just after leaving the country, Leopoldo Castillo defended his career in an interview with the newspaper El Mundo Economía y Negocios. "The first thing I want to clarify is that the insurance company in Panama has nothing to do with the insurance company in Venezuela, and the bank in Aruba does not have anything to do with the bank in Venezuela," he said. He argued that the intervention of his entities was a political retaliation, implying that it was due to the fact that he provided collective insurance to opposition state governments, namely Miranda and Carabobo.

As to the criticism of policyholders who claimed reimbursement with more than a year past due, he said: "I manage a million and a half clients. Five or ten complaining is not significant to me. They must be specific cases where some documents are missing... I am not the Baby Jesus, nor do I intend to be. But I am a correct person. I do not steal anything from anyone." An interview request made by email to Leopoldo Castillo was accepted by an assistant in the Dominican Republic, but could not be done by the time of the publication. The possibility for have his statement is open.

Pequiven, a subsidiary of Petróleos de Venezuela, sought shelter in tax havens to legalize its association with Iranian company National Petrochemical Company, from which Veniran emerged. Although the Panamanian law firm was suspicious of the alliance between the then presidents Hugo Chávez and Mahmud Ahmadinejad, it finally solved the inconvenience to please both clients.

Leonardo González Dellán headed Banco Industrial de Venezuela (BIV) from 2002 to 2004. The papers of Mossack Fonseca reveal that, in this period, which also coincided with the establishment of the exchange control and the birth of the extinct Cadivi, he was related to overseas companies.

The last two major global investigations conducted by the International Consortium of Investigative Journalists revealed the offshore business of Eligio Cedeño, a former Venezuelan banker considered a fugitive from justice by some and politically persecuted by others. Company Cedel International Investment, owner of Bolívar Banco and Banpro, also requested the services of Mossack Fonseca to operate in the British Virgin Islands.

The name of the former head of the Venezuelan oil company in Colombia appears in the papers of Mossack Fonseca with 100% of the shares of a company created in June 2011, of which she requested to be dissolved six months later. She is unemployed since August 2015, when she was replaced by the ex-sister-in-law of President Nicolás Maduro

The so-called "insurance tsar" opened four offshore companies in a Caribbean island through the Panamanian law firm Mossack Fonseca. Corporación OFL, which consists of about 20 companies in his name, makes him one of the entrepreneurs in the insurance sector that has grown the most during the chavista government.

The ex-banker used the services of the Panamanian law firm Mossack Fonseca to register companies in tax havens while he was being tried in Venezuela by his ex-colleagues from the Stanford Group. He said he was a victim of chavism to be accepted as a client and thus protect his fortune.

When Vice President Delcy Rodríguez turned to a group of Mexican friends and partners to lessen the new electricity emergency in Venezuela, she laid the foundation stone of a shortcut through which Chavismo and its commercial allies have dodged the sanctions imposed by Washington on PDVSA’s exports of crude oil. Since then, with Alex Saab, Joaquín Leal and Alessandro Bazzoni as key figures, the circuit has spread to some thirty countries to trade other Venezuelan commodities. This is part of the revelations of this joint investigative series between the newspaper El País and Armando.info, developed from a leak of thousands of documents.

Leaked documents on Libre Abordo and the rest of the shady network that Joaquín Leal managed from Mexico, with tentacles reaching 30 countries, ―aimed to trade PDVSA crude oil and other raw materials that the Caracas regime needed to place in international markets in spite of the sanctions― show that the businessman claimed to have the approval of the Mexican government and supplies from Segalmex, an official entity. Beyond this smoking gun, there is evidence that Leal had privileged access to the vice foreign minister for Latin America and the Caribbean, Maximiliano Reyes.

The business structure that Alex Saab had registered in Turkey—revealed in 2018 in an article by Armando.info—was merely a false start for his plans to export Venezuelan coal. Almost simultaneously, the Colombian merchant made contact with his Mexican counterpart, Joaquín Leal, to plot a network that would not only market crude oil from Venezuelan state oil company PDVSA, as part of a maneuver to bypass the sanctions imposed by Washington, but would also take charge of a scheme to export coal from the mines of Zulia, in western Venezuela. The dirty play allowed that thousands of tons, valued in millions of dollars, ended up in ports in Mexico and Central America.

As part of their business network based in Mexico, with one foot in Dubai, the two traders devised a way to replace the operation of the large international credit card franchises if they were to abandon the Venezuelan market because of Washington’s sanctions. The developed electronic payment system, “Paquete Alcance,” aimed to get hundreds of millions of dollars in remittances sent by expatriates and use them to finance purchases at CLAP stores.

Scions of different lineages of tycoons in Venezuela, Francisco D’Agostino and Eduardo Cisneros are non-blood relatives. They were also partners for a short time in Elemento Oil & Gas Ltd, a Malta-based company, over which the young Cisneros eventually took full ownership. Elemento was a protagonist in the secret network of Venezuelan crude oil marketing that Joaquín Leal activated from Mexico. However, when it came to imposing sanctions, Washington penalized D’Agostino only… Why?

Through a company registered in Mexico – Consorcio Panamericano de Exportación – with no known trajectory or experience, Joaquín Leal made a daring proposal to the Venezuelan Guyana Corporation to “reactivate” the aluminum industry, paralyzed after March 2019 blackout. The business proposed to pay the power supply of state-owned companies in exchange for payment-in-kind with the metal.