China wired US$1 billion to Hugo Chávez's government and tied it to the sale of an astronomical amount of iron ore, as debt grew and ambitious projects never materialised

|

Getting your Trinity Audio player ready...

|

The commitment was titanic. China would lend Venezuela US$1 billion as soon as the deal was sealed and, in exchange, state-run mining company CVG Ferrominera Orinoco would deliver 42.96 million tonnes of iron ore to Chinese steel company Wuhan Iron and Steel Corporation (Wisco) over the next eight years. The agreement was signed in 2009, the same year that production at the Venezuelan company, part of the Corporación Venezolana de Guayana (CVG) conglomerate, plummeted by around 35%.

But those were also the times of oil bonanza and political hegemony. President Hugo Chávez had declared himself a "socialist" in 2006 and his party was in almost complete control of the National Assembly, following the opposition's desertion in 2005 parliamentary elections. He had the power and political clout to strengthen a network of new international allies, including China. The relationship with the Asian country flourished amidst dozens of new projects put together over long meetings, memoranda and billions of dollars.

In the midst of this intoxication, on 22 December 2009, without any assessment, China Development Bank (CDB) poured $1 billion into the coffers of the Venezuelan Economic and Social Development Bank (Bandes). The funds were destined for projects that would improve Venezuela’s iron ore production and the production capacity of the CVG Ferrominera company in the state of Bolívar, in the south of the country.They would be repaid by Venezuela with the proceeds from the sale of 42.96 million tonnes of iron ore to Wisco. The agreement also foresaw that Chinese companies would be contracted for those improvement works, according to documents accessed by Armando.info and processed and analysed together with the data team of the Latin American Centre for Investigative Journalism (CLIP), with additional reporting by Diálogo Chino.

This was no regular export deal. If China had paid for the 42.96 million tonnes in advance and according to international iron ore prices in 2009, it would have had to wire the Caribbean country a figure nearer $4.176 billion.

Under the terms of this exchange, dressed as cooperation for the development of Venezuela's export capacity of this commodity needed to produce steel, China was in effect buying cheap ore. But, as it would turn out, the huge 75% discount was linked to a very high risk of default by its South American partner.

The timing of the deal was tight. According to the sales contract that had been signed two months earlier, on 22 October 2009, CVG Ferrominera was obliged to deliver Wisco a first installment of 160,000 tonnes of material by the end of that month. Two more deliveries were to follow: one of 160,000 tonnes in November and another in December for an additional 140,000 tonnes. Delivery of the ore was delayed, but the quota for that year was eventually met. In the first half of 2010, Ferrominera delivered a further 460,000 tonnes of iron ore that corresponded to the previous year’s quota.

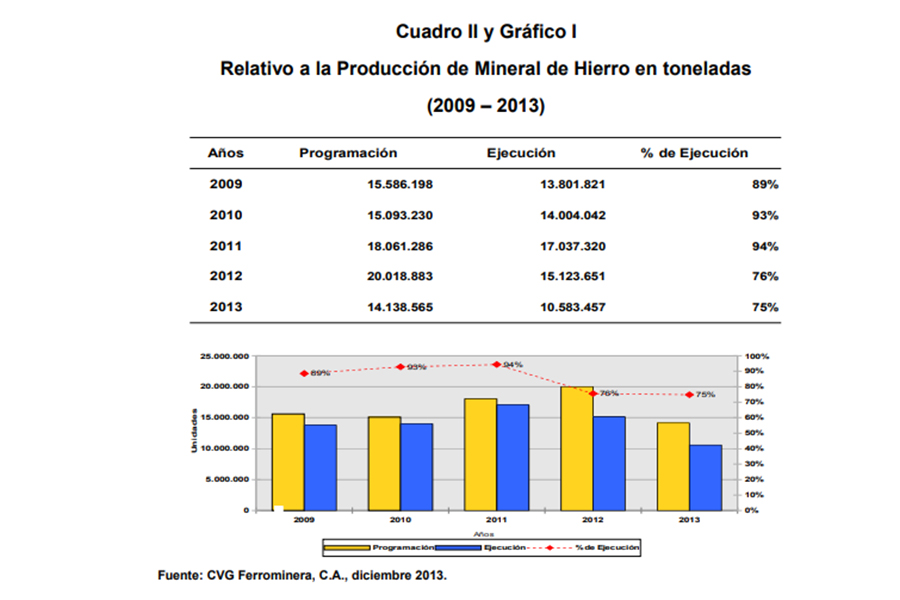

For 2010, the agreed quota was much higher, at 4 million tonnes, or 29% of Ferrominera's eventual total production that year, just over 14 million tonnes, according to the Ministry of Basic Industries' 2013 Annual Report. The goal was ambitious but looked achievable if the improvements laid down in the Chinese loan were carried out. They weren’t. It soon became clear that there was no alchemy that could transform the initial optimism of Beijing and Caracas into iron ore.

By 30 June, 2010, CVG Ferrominera had delivered just 337,250 tonnes of iron ore, less than 10% of the total pledged. To meet its commitment for that year, it had to deliver on its outstanding balance of 3,461,946 tonnes, with only six months to go.

A joint report by the Venezuelan delegation to the CVG Financing Agreement and China Development Bank (CDB) warned that the Venezuelan company was in dangerous waters and that, if it failed to meet the schedule, it would be obliged to pay China an amount equivalent to the volume not delivered at the agreed price. In other words, almost US$70 million, in addition to payments for transport, cargo loading and unloading, among others.

It didn't take long for the poor planning of these monumental projects funded by Chinese money to be exposed, along with no guarantees of compliance. "Minister [Rodolfo] Sanz made promises that Corporación Venezolana de Guayana was unable to keep and committed Ferrominera to supplying iron ore at levels it does not have," complained Tian Yunhai, deputy director of CBD's international cooperation department, during an urgent meeting in Beijing in December 2010 to discuss the failure to honour the agreement.

Gradually, Venezuelan authorities realised that they had signed a contract that was not favourable to them and very difficult to fulfil.

A report presented by the Venezuelan delegation to the CVG Financing Agreement and China Development Bank (CDB) in June 2010 detailed that the iron ore delivery contract signed with Wisco did not generate income for CVG Ferrominera. "Although so far there has been enough ore in inventory to cover commitments, it is necessary to recover and increase CVG Ferrominera's production capacity to guarantee the volume of iron ore to China, without detriment to its other commitments (...) It is essential to have other sources of income to meet contractual and operational commitments, and currently this source is exporting to Europe," the document says.

The report highlighted the company's operational and logistical inability to meet a commitment of the size agreed upon. "In order to increase transport capacity, the ship Río Caroní, which is currently undergoing major repairs at the Curaçao dock, is required. The cost of these repairs amounts to US$9 million, which CVG Ferrominera does not have. To date this payment has been delayed for two months and the Curaçao dock states that it will remove the vessel without completing the repairs if the delay in payment persists. This would imply that the vessel would be anchored and out of operations, with the consequent associated costs," the document says.

In a rare sample of realism, the report held back on neither detail or sentiment. It admitted that the company did not have the funds to cover the costs of materials and spare parts that would allow it to reach operational capacity in the extraction, processing and transport processes. Moreover, it could not afford to maintain the Boca Grande II transfer station, the largest floating iron ore transfer station in the world, located in the Columbus Channel (otherwise known as the Serpent’s Mouth), which lies opposite the mouth of the Orinoco River between Venezuela and the islands of Trinidad and Tobago.

Another drawback was listed in the report. The port capacity of the Boca Grande II station did not match that of the vessels hired by the Chinese company Wisco to transport the ore. To make matters worse, those vessels did not have GPS-assisted navigation systems to allow for night navigation, slowing transit through the treacherous waters of the channel.

In addition to the fact that the iron committed to the Chinese company came at a significant price discount, there was the prospect of an imminent decrease in Ferrominera's income from sales to its domestic customers in the industrial sector. A plan to cut energy consumption was already in force. It was the year of the electricity emergency decreed by Chávez, which foresaw important limitations for heavy industry.There were also technical problems in the direct reduction plants in the Guayana region (Matesi, Orinoco Iron, FMO Briquette Plant and Comsigua) that are responsible for the second process in the iron production cycle, which consists of reducing pellets so they become suitable for making steel, a process which also includes the removal of the oxygen in the iron oxide.

The report, drafted at the request of Venezuela's Ministry of Basic Industries and Mining (Mibam), proposed an extraordinary investment of $50 million to address urgent issues that could overcome some of these obstacles and increase Ferrominera's production line.

"Failure to take immediate action will result in non-compliance with the loan contract as of September 2010 and with the supply contract as of December 2010, which would generate the legal and economic consequences already described. However, such actions also do not guarantee the due fulfilment of all obligations under the various contracts for subsequent years, as their fulfilment will depend on structural reforms in the company," the report warns.

Despite the fact that the $1 billion credit line, which according to the commitment Venezuela was to pay with 42.96 million tonnes of iron ore, was intended to improve the company's production and dispatch capacity, in the report the Venezuelan representation stated that "CVG Ferrominera has not benefited from the funding".

Beyond ensuring materials needed to fuel its economic growth, one possible explanation for China's interest in securing supplies of Venezuelan iron ore is its quality, which is judged by how much iron it contains. More than 65% is considered as high-grade. Anything between 62% and 64% is considered average-grade. “Among the proven reserves [in Venezuela] the average grade of 1.748 billion tonnes is 63.51% and that of 4.176 billion tonnes is 41.2%. This proportion is rare in the world,” Zhan Hongkun, the chief engineer of China Railway 10th Engineering Group (a subsidiary of CRECG) in Venezuela, told China’s People’s Daily in 2018. Additionally, the ease of extracting Venezuelan iron ore suits industrial use. Zhan’s said: "the mining difficulty is small, the iron ore is all located above the surface, and can be directly loaded and transported after being excavated".

According to Rebecca Ray, a researcher at Boston University’s Global Economic Governance Initiative (GEGI) who has extensively studied Chinese loans in Latin America, the deal appears to follow a traditional model of commodity-backed lending.

“Rather than direct repayment in kind, they entail commodity shipments to a Chinese firm (in this case, Wisco), which then channels the proceeds from the sale to an account linked to the loan. Typically, if the value of shipments surpasses the amount needed for repayment, the surplus proceeds can be returned to the borrowing country as normal export revenue. Obviously in this case, with the mining company struggling, we don’t expect that there are surplus shipments,” said Ray, who maps China’s Overseas Development Finance.

Without improvements in production capacity, in 2010 Ferrominera Orinoco was barely able to deliver 514,250 tonnes of iron ore, just 13.45% of its commitment for that year.

“Unfortunately, as far as I know the details of the deal have never been made public, so we cannot confirm if it follows the traditional pattern,” she added.

At the end of 2010, the Chinese partner complained about Venezuela’s non-delivery of its side of the deal.

On December 9, a meeting was held at CDB’s headquarters in Beijing. Edmée Betancourt, president of the Venezuelan Economic and Social Development Bank (Bandes), was supposed to attend. Instead, Richard Miranda, compliance officer of Bandes, and Guadalupe Franco, first secretary of Venezuela’s Beijing embassy, were present.

During the meeting, Tian Yunhai, deputy director of CDB's international cooperation department, expressed his annoyance. "Both the bank and Wisco expected a response from Venezuela vis-a-vis cooperation and sincere dialogue. However, the negotiations led by Ferrominera veered far from that goal, presenting only a purely commercial position and with supply ranges that did not meet Wisco's expectations," said the official, according to documents to which Armando.info had access. Tian recalled that in 2009, when the then minister of Basic Industries and Mining, Rodolfo Sanz, made an emergency request for resources from the bank, "its response was in line with the confidence it maintains in cooperation with Venezuela".

The aim of the meeting was to receive CDB’s proposal for the use of the credit line, but Chinese representatives complained about the absence of the recently appointed minister of Basic Industries and Mining, José Khan, and of Edmée Betancourt, president of Bandes, who until then had represented Venezuela during contract negotiations with China. "The situation is affecting the financial relationship with Venezuela and I am sure that this situation would not be to the liking of President Hugo Chávez," Tian said.

The day after the meeting, the Venezuelan Diplomatic Commission in China received an urgent communication from Tian. He informed them of an urgent visit to Venezuela in 30 days, accompanied by bank officials and Wisco's technical team, to evaluate the productive capacity and logistical conditions and begin carrying out planned projects by the end of 2011. "The objective is to solve CVG's production and logistics problems as soon as possible," he said.

Improving Ferrominera's iron ore production and dispatch capacity justified CDB’s US$1 billion loan that obliged the Venezuelan state-owned company to commit 42.96 million tonnes of output . But the mine's upgrading projects saw as many setbacks as did its attempts to meet the payment schedule.

At a meeting on 30 May 30 2011, Ferrominera and Wisco signed a new agreement committing the Chinese company to design and implement two projects with the state-owned China Railway Engineering Corporation Group (CREC), including the "expansion of the operational capacity of the Palúa dock", in the small port in the northeast of San Félix, a city in Bolívar state, and the "dredging of the Orinoco River". The agreement also contemplated a third project to be developed by Wisco for the "purchase of machinery and spare parts for the mines", in order to alleviate the operational and infrastructure crisis faced by the company.

Three months later, on August 10 2011, after several meetings between Ferrominera and Wisco, the parties concluded that the projects should be executed by companies specialised in these areas. Wisco finally admitted that it did not have sufficient experience to undertake engineering work to expand the operational capacity of the Palúa dock or to dredge the Orinoco. It therefore informed Ferrominera that both projects were to be handed over to third parties, awarding the dredging project to China Railway Engineering Corporation Group (CRECG) and China Communications Construction Company (CCCC), which, as Diálogo Chino has shown, has more than 50 projects in Latin America. The expansion of the operational capacity of the Palúa wharf was awarded to China Railway 10th Engineering Group Co., a subsidiary of CRECG.

Wisco would thus be left with only one of the three projects mooted in the original agreement, for the purchase of machinery and spare parts for the mines.

On 5 September 2011, Ferrominera signed a contract with China Communications Construction Company (CCCC) for the maintenance, dredging and deepening of the Orinoco River channel, between miles 0 and 42 of its outer channel and miles 42 and 196 of its inner channel. On the same day, the Venezuelan state-owned company gave the go-ahead to China Railway N° 10 Engineering Group Co, Ltd to begin a number of works at the the Palúa wharf. These included the construction, installation and commissioning of receiving hoppers for fine and coarse iron ore, conveyors, a transfer house, a stacker with a capacity of 3,500 tn/h, a reclaimer, a mud loader, a stacking yard, and the construction of 2.5 km of closed-circuit railway track for the entry, unloading and exit of trains.

Both works were due to start in October 2011 and stated to be completed fourteen months later, in December 2012.

But while the infrastructure improvement projects did not materialise, Ferrominera faced increasing delivery commitments and difficulties in meeting them. In 2011 it had to deliver a quota of six million tonnes, or 35% of total production that year. For 2012, that quota rose to 6.5 million tonnes, some 43% of production which, as it turned out, would barely reach 15 million tonnes, according to the Ministry of Basic Industries report from that year.

In the end, the Palúa wharf was the only project to be completed, some five years behind schedule and after Hugo Chávez had died. Marcial Arenas, the then vice-minister of Industrial Planning and Strategic Investments, and Isaías Suárez Chourio, president of the state mining company inaugurated the work on January 31, 2017, during the presidential TV show “Contacto con Maduro”, along with CREC representatives.

The year 2013 marked the definitive collapse of the iron ore industry, with millions in debts to be collected. Nationalised in 1975, a year before the oil industry, the exploitation of the iron ore deposits in Bolívar state was the first pillar of a state plan of successive democratic governments to turn the southern bank of the Orinoco River into a global hub for steel and heavy industry. Ferrominera, built up from operations previously held by US companies, was fundamental to this vision.

In 2013, the president of Ferrominera, Radwan Sabbagh, admitted in a public interview that the company faced difficulties even in its payment for electricity, gas, social security and contractual commitments assumed through the National Bank of Housing and Habitat (Banavih). At the same time, an important part of production was mortgaged by the contract with China, which left the company with no direct profits. The international price of iron ore that year averaged US$135 per tonne, whereas Venezuela had accepted a deal in which it was delivering a tonne at $23. Caracas had squandered a decade of soaring commodity prices driven, ironically, by China's appetite.

Worst of all, the suffocating commitment had further to run. By 2013, the promise of ore deliveries amounted to 6.5 million tonnes. That year, Ferrominera's total production was 10 million tonnes. In other words, 620 grammes out of every kilogram of iron produced in 2013 was had been “paid for” long before by its Chinese customer.

The 2013 official document titled “Memory and Account”, drafted by the Ministry of Basic Industries, gives an explanation for the sharp decline in national production of iron and steel. This was due to "the accumulated effects of the old capitalist management scheme that prevailed, as well as the historical disinvestment of the old management model of these factories, in equipment and scheduled maintenance to ensure the availability of the equipment necessary for the sustainability of production and sales", it said.

But that statement was not credible. Something else must have been going on. To find out, Caracas dispatched an intelligence agent to Ciudad Guayana, at the juncture of the towns of San Félix and Puerto Ordaz, where the Caroní River meets the Orinoco and where CVG’s headquarters are located, the heart of Venezuela’s heavy industry. It was the beginning of a corruption scandal that ended up engulfing the agent himself: Juan Carlos Álvarez Dionisi, also known as “The Shark” and a colonel in the Bolivarian National Guard.

On June 12, 2013, President Nicolás Maduro, who had only just been elected the previous April after the death of Chávez, announced the arrest of Ferrominera president Radwan Sabbagh, who had earlier complained about the impossibility of paying utility bills. Sabbagh was later sentenced to six years in prison after admitting his responsibility in the diversion of more than US$1.8 million during his tenure between 2006 and 2013. Several other Ferrominera officials also ended up in prison, including finance manager María Acosta, administrative manager María Rodríguez, legal consultant Noel Ramírez, former technical operations manager Ángel Ramón Campero Franco and a businessman, Yamal Mustafá, who had extensive links to the long-time governor of Bolívar state and prominent ‘chavista’, Army General Francisco Rangel Gómez.

The announcement uncovered several crimes linking Ferrominera's top management to a corruption scheme involving the sale of iron ore at preferential prices to intermediary companies that then placed the product on the international market. It also revealed that those involved had bribed Álvarez Dionisi, who was sent to investigate the irregularities, to not report them. "The Shark" was charged by the 54th national and 2nd assistant national prosecutors, Nelly Sánchez Pantaleón and Maryori Da Cunha, respectively, with the crimes of extortion, money laundering and criminal association.

In the aforementioned 2013 report, the Industry Ministry refers to the investigation and notes that "as a result of this and other allegations, part of the management team of the plant was dismissed and various arrests were made by the competent agencies".

Chinese executives, frustrated and faced with the inability of their commercial partner - now also plagued by a corruption scandal - to comply with the agreements, were forced to evaluate and renegotiate the projects, seeking a real recovery in production.

"The project 'Expansion of the capacity of the Palúa dock' did not show progress in the physical goal, since it was reached at the end of 2014 with the completion of the facilities," the document says. It adds that the project plans were received "in built condition", tests were carried out without load and with load that allowed the correction in different points of the installed systems and the signing of the provisional acceptance minutes, although it was pending finalize technical assistance to the project.

Meanwhile, in 2016, Wisco, based in Wuhan -the city later elevated to a dismal celebrity by the coronavirus-, merged with Shanghai-based Baoshan Iron and Steel Group (Baosteel) as part of a comprehensive reform of the state enterprises started by the Chinese government. The result of this operation was that the company, now called Baowu Steel Group, became the second largest steel company in the world. It is not clear if Ferrominera's contractual obligations passed to that group. According to Panjiva, a company that records international trade data, between 2017 and 2018, Ferrominera still exported about three million tons of iron ore per year to China.

The last public announcement made by Nicolás Maduro assured that, in October 2019, Ferrominera would once again produce three million tons of material per year. A year after that forecast, the ovens located within the Punta Cuchillo industrial complex, in the Matanzas industrial area, west of Ciudad Guayana, remained off, while the company's production figures continue to decline, without even having reached the two million tons in 2020, one-seventh of what Ferrominera was producing a decade earlier, when it received credit from China for its expansion.

When Vice President Delcy Rodríguez turned to a group of Mexican friends and partners to lessen the new electricity emergency in Venezuela, she laid the foundation stone of a shortcut through which Chavismo and its commercial allies have dodged the sanctions imposed by Washington on PDVSA’s exports of crude oil. Since then, with Alex Saab, Joaquín Leal and Alessandro Bazzoni as key figures, the circuit has spread to some thirty countries to trade other Venezuelan commodities. This is part of the revelations of this joint investigative series between the newspaper El País and Armando.info, developed from a leak of thousands of documents.

Leaked documents on Libre Abordo and the rest of the shady network that Joaquín Leal managed from Mexico, with tentacles reaching 30 countries, ―aimed to trade PDVSA crude oil and other raw materials that the Caracas regime needed to place in international markets in spite of the sanctions― show that the businessman claimed to have the approval of the Mexican government and supplies from Segalmex, an official entity. Beyond this smoking gun, there is evidence that Leal had privileged access to the vice foreign minister for Latin America and the Caribbean, Maximiliano Reyes.

The business structure that Alex Saab had registered in Turkey—revealed in 2018 in an article by Armando.info—was merely a false start for his plans to export Venezuelan coal. Almost simultaneously, the Colombian merchant made contact with his Mexican counterpart, Joaquín Leal, to plot a network that would not only market crude oil from Venezuelan state oil company PDVSA, as part of a maneuver to bypass the sanctions imposed by Washington, but would also take charge of a scheme to export coal from the mines of Zulia, in western Venezuela. The dirty play allowed that thousands of tons, valued in millions of dollars, ended up in ports in Mexico and Central America.

As part of their business network based in Mexico, with one foot in Dubai, the two traders devised a way to replace the operation of the large international credit card franchises if they were to abandon the Venezuelan market because of Washington’s sanctions. The developed electronic payment system, “Paquete Alcance,” aimed to get hundreds of millions of dollars in remittances sent by expatriates and use them to finance purchases at CLAP stores.

Scions of different lineages of tycoons in Venezuela, Francisco D’Agostino and Eduardo Cisneros are non-blood relatives. They were also partners for a short time in Elemento Oil & Gas Ltd, a Malta-based company, over which the young Cisneros eventually took full ownership. Elemento was a protagonist in the secret network of Venezuelan crude oil marketing that Joaquín Leal activated from Mexico. However, when it came to imposing sanctions, Washington penalized D’Agostino only… Why?

Through a company registered in Mexico – Consorcio Panamericano de Exportación – with no known trajectory or experience, Joaquín Leal made a daring proposal to the Venezuelan Guyana Corporation to “reactivate” the aluminum industry, paralyzed after March 2019 blackout. The business proposed to pay the power supply of state-owned companies in exchange for payment-in-kind with the metal.